Overview

This unit examines the role of insurance and risk management in client focused financial planning. You will analyse the insurance needs of clients and construct a strategic insurance and risk management plan. You will examine general and life insurance products and their suitability for a client's situation.

Details

Pre-requisites or Co-requisites

There are no requisites for this unit.

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 2 - 2025

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Undergraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from Feedback given by the Student in the form of MyExperience responses.

On the 22 July 2024 a student scored their satisfaction an 8 and on the 19 September 2024 another student scored their satisfaction a 9.

Continue to update the content and assessment tasks to keep the level of satisfaction high.

Feedback from Self-reflection

Usefulness of learning materials needs improving

Prescribed an updated Insurance Planning textbook for 2025.

Feedback from Recommendations by CQU Learning Design & innovation team, discussions with Discipline colleagues from the Economics, Finance, Property Disciplines

Low content engagement, especially pre-recorded content video recordings because they are considered too long by students

"Chunking" video recordings by topic instead of one long pre-recorded content video

- Explain the principles and legal framework of the Australian insurance industry

- Analyse insurance needs of clients to solve risk management problems

- Research and select appropriate insurance products

- Construct strategic insurance and risk management plan.

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Practical Assessment - 50% | ||||

| 2 - Take Home Exam - 50% | ||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Communication | ||||

| 2 - Problem Solving | ||||

| 3 - Critical Thinking | ||||

| 4 - Information Literacy | ||||

| 5 - Team Work | ||||

| 6 - Information Technology Competence | ||||

| 7 - Cross Cultural Competence | ||||

| 8 - Ethical practice | ||||

| 9 - Social Innovation | ||||

| 10 - First Nations Knowledges | ||||

| 11 - Aboriginal and Torres Strait Islander Cultures | ||||

Alignment of Assessment Tasks to Graduate Attributes

| Assessment Tasks | Graduate Attributes | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

| 1 - Practical Assessment - 50% | |||||||||||

| 2 - Take Home Exam - 50% | |||||||||||

Textbooks

Insurance and Risk Management: The Definitive Australian Guide

Edition: 5th (2023)

Authors: John Teale

John Teale

Woodgate Woodgate , Queensland , Australia

ISBN: 9780645745603

To make a purchase request source here or your own sources:

To make a purchase request source here or your own sources:

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

- Financial Planning Software

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

a.mcinnes@cqu.edu.au

Module/Topic

- Nature of Risk and its Management

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 1 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Module/Topic

- Introduction to Insurance and Risk Management

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 2 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Module/Topic

- Personal Risk Management

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 3 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Module/Topic

- Introduction to Life Insurance and Life Insurance Products

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 4 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Module/Topic

- Regulation and Compliance

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 5 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Module/Topic

- Vacation and catchup week

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

- Revising Weeks 1 to 5

- Assessment completion

- Catching up incomplete Modules from Weeks 1 to 5

Module/Topic

- Concepts Underlying Insurance Policy Law

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 6 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Module/Topic

- Claims and Underwriting

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 7 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Module/Topic

- Introduction to General Insurance and General Insurance products

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 8 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Module/Topic

- Taxation

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 9 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Module/Topic

- Mandated Insurances

- Student Evaluation Survey

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 10 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Scoped Insurance Statement of Advice Due: Week 10 Monday (22 Sept 2025) 11:45 pm AEST

Module/Topic

- The Concept of Ethics

Chapter

Prescribed Reading in the Study Guide

Events and Submissions/Topic

Refer to Week 11 in Moodle for:

- Study Guide

- Weekly Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Live Zoom Workshop Recordings

Module/Topic

- Revision

- Exam Preparation

- Student Evaluation Survey

Chapter

Refer to Assessment Section on Moodle for Exam Advice

Events and Submissions/Topic

- Revise all Study Guides

- Revise all Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Watch final Online Live Zoom Workshop Recordings

- Prepare for the Exam, including referring to Previous Exam Papers and Zoom Workshop Recording

- Complete "Have Your Say" Student Evaluation Survey

Module/Topic

- Exams

Chapter

Prescribed Reading in the Study Guides from Weeks 1 to 12

Events and Submissions/Topic

EXAMINATION Due: Review/Exam Week Wednesday (15 Oct 2025) 4:00 pm AEST

Module/Topic

Wishing you all the best with your futures.

Chapter

Events and Submissions/Topic

Unit Coordinator End of Term Report

- Available once finalized by all the relevant Committees and after Certification of Grades

1 Practical Assessment

This is a group assessment. Groups can comprise 1, 2 or 3 members. No more than 3 members per group are permitted.

The teaching approach of this unit is experiential simulated work-integrated learning using case studies.

Experiential Learning Theory was developed by David Kolb where students learn through experience, reflection, conceptualization, and experimentation.

This theory emphasizes learning through experience, reflecting on those experiences, so the student can apply a simulation of the real world and what is learned to their future role as financial adviser.

Using a client case study the student is expected to complete a partially completed financial plan focused on personal life insurance strategies and product recommendations for a couple.

This assessment allows the student to engage with a real-world detailed case study, and help the client achieve their wealth protection goals using term life, total permanent disability, trauma and income protection strategies and real-world products. Not only do the student learn new knowledge but learn to apply the newly acquired knowledge to the case study.

Combining the case study with a simulated work-integrated approach gives students hands-on experience of what it is like to work in a professional practical setting, dealing with a simulated real-world task of completing a financial plan through experimenting with strategies and solutions based on their learning.

Important detailed information for your assessment is on the Moodle site in the <Assessments> tile.

Before you begin the assessment please download and read the:

- Instructions for completing and submitting your assessment [File 1].

- Case study background information and completed Fact Find [File 2].

- Scoped Insurance Statement of Advice template [File 3].

Please download all three files relating to this Assessment requirements from Moodle and read these long documents carefully.

Your task is to:

- Read the instructions document provided for this case study assessment.

- Identify the client's insurance goals, objectives, needs and financial situation by reviewing the background information and completed Fact Find document.

- Prepare a written financial plan document from the information provided in the completed Fact Find using the Microsoft-Word template provided.

- You will have access to financial planning software Midwinter (recommended), Microsoft-Excel and/or related software [which we will make available to you via Moodle] to complete the assessment.

Learning how to use new software [for instance, Midwinter if you choose to use it] may need sometime and practice.

Your lecturer and peers are available via Moodle Q&A Forums to address any unit content or assessment matter.

Only email your lecturer directly to address any personal concerns or difficulties that cannot be shared on the public forums during the term.

Please start this assessment as soon as possible, because for some of you it will require learning numerous new skills.

This assignment has the reputation for being challenging, yet useful in terms of how it builds wealth protection knowledge as well as provides employable skills.

Week 10 Monday (22 Sept 2025) 11:45 pm AEST

Download the Assessment file/s from Moodle

Week 12 Monday (6 Oct 2025)

Feedback will be provided in the Statement of Advice and Rubrics document uploaded onto Moodle via the Assessment tile.

Find a comprehensive marking criteria sheet (rubrics) in the instructions file of the assessment on Moodle in the <Assessments> tile.

- Explain the principles and legal framework of the Australian insurance industry

- Analyse insurance needs of clients to solve risk management problems

- Research and select appropriate insurance products

- Construct strategic insurance and risk management plan.

- Communication

- Problem Solving

- Critical Thinking

- Information Literacy

- Team Work

- Information Technology Competence

- Cross Cultural Competence

- Ethical practice

2 Take Home Exam

- This is an individual assessment. Group submissions are not permitted.

- Collaboration with other students will result in an academic misconduct allegation for all students involved. This may result in a failure result for this assessment. Please note that your paper will be submitted through Turnitin and related GenAI detection software.

- This is a non-invigilated online open book timed exam of 3 hours, including downloading, uploading, and submission time.

- There is a minimum exam grade of 50% to pass the unit.

- You will be typing your answers in the examination Microsoft-Word template document provided.

- Late submissions will not be marked.

- If you encounter problems submitting your paper to Moodle, email it to your unit coordinator by the due date and time.

Review/Exam Week Wednesday (15 Oct 2025) 4:00 pm AEST

Download the exam from Moodle Assessment tile on the exam scheduled date and time. 1:00PM AEST to 4.00PM AEST

Exam Week Wednesday (22 Oct 2025)

Upload and submit the exam via Moodle Assessment block by the exam scheduled due date and time after 3 hours

Grading as per the Online Take Home timed Exam Advice of three hours to meet the learning outcomes.

- Analyse insurance needs of clients to solve risk management problems

- Construct strategic insurance and risk management plan.

- Communication

- Problem Solving

- Critical Thinking

- Information Literacy

- Information Technology Competence

- Cross Cultural Competence

- Ethical practice

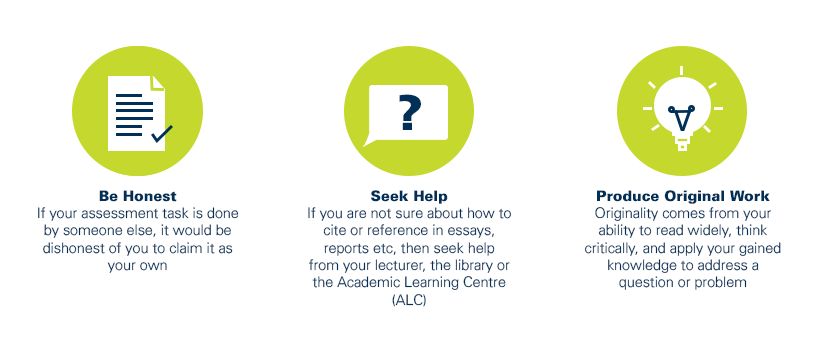

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?