Overview

This unit is the foundation unit for students completing the Financial Planning stream and covers the professional financial planning process, including the Australian legal framework and the responsibilities of financial planners. You will learn how to investigate a client's financial situation and turn the core elements of financial planning into a strategic financial plan. You will also be introduced to financial planning software, tools and templates used in real-world financial planning practice as well as communication methods aimed at building long term client relationships.

Details

Pre-requisites or Co-requisites

There are no requisites for this unit.

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 1 - 2024

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Undergraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from Student Evaluations

The volume of content and resources can be overwhelming.

Continue to review and reduce the volume of content and resources as far as possible without compromising the integrity of the unit.

Feedback from Student Evaluations

More flexibility for people not able to attend live lectures.

Provide students who cannot attend the live online workshops, not only the pre-recorded workshop recordings, but opportunity to do one-on-one Zoom sessions at other times of eh week.

- Explain and apply the process and Australian legal framework of financial planning.

- Present strategic advice which meets the financial planning needs and objectives of clients in a variety of circumstances.

- Communicate effectively with clients to solve financial planning problems.

- Construct financial planning scenarios using industry standard software.

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Practical Assessment - 30% | ||||

| 2 - Practical Assessment - 30% | ||||

| 3 - Take Home Exam - 40% | ||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Communication | ||||

| 2 - Problem Solving | ||||

| 3 - Critical Thinking | ||||

| 4 - Information Literacy | ||||

| 5 - Team Work | ||||

| 6 - Information Technology Competence | ||||

| 7 - Cross Cultural Competence | ||||

| 8 - Ethical practice | ||||

| 9 - Social Innovation | ||||

| 10 - Aboriginal and Torres Strait Islander Cultures | ||||

Alignment of Assessment Tasks to Graduate Attributes

| Assessment Tasks | Graduate Attributes | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

| 1 - Practical Assessment - 30% | ||||||||||

| 2 - Practical Assessment - 30% | ||||||||||

| 3 - Take Home Exam - 40% | ||||||||||

Textbooks

There are no required textbooks.

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

- Microsoft Teams (both microphone and webcam capability)

- Financial Planning Software

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

a.mcinnes@cqu.edu.au

Module/Topic

Personal Financial Planning and the Economic Environment

- Critical lessons from global, economic history

- Economic, financial and psychological risks underpinning the need for effective financial planning

- Status of national financial literacy levels

Professional and Legal Responsibilities of Financial Planners [FPs] and FASEA Codes of Ethics and Standards

- Introduction to compliance and legislative regimes including FASEA Codes of Ethics, Best Interest and Fiduciary Duties

- Professional Codes of Conduct of FPs

- Professional associations including FPSB & FPA and the role of stakeholders

- Case studies and lessons from corporate scandal, national investigations and industry debate

- Modalities and financial planning theories

Chapter

Refer to Study Guide for:

- Week 1 Prescribed and Supplementary Reading

Events and Submissions/Topic

Refer to Orientation Section in Moodle for:

- What's Happening this term

- Work through the 'Study Guide' for Week 1

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Start the Practical Assessment 1 Part 1 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

Module/Topic

Financial Planning Skills

- Preparation or personal financial statements, cash flows and budgets

-

Analyzing financial statements using ratio analysis

- Mathematics for financial advisers

- Time value of money concepts, net present value and compounding interest

- Taxation effects on returns

- Nominal, effective and real rates of returns

Chapter

Refer to Study Guide for:

- Week 2 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 2

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Continue working on the Practical Assessment 1 Part 1 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

Module/Topic

Structure, Layout and Purpose of a Statement of Advice

- Legislative framework governing quality financial advice in Australia

- Analysis and evaluation of goals, current financial situation and risk capacity

- Connecting needs, risk tolerance and risk capacity to investment choices

- Gathering data and ascertaining the client's wealth and risk capacity

- Understanding the objectives, values, responsibilities, behaviours and tolerances for risk of the client

- Client communication, effective questioning, framing, listening techniques

- Conducting the initial client interview and creating a trusted relationship

- Statement of Advice development process and write-up

Chapter

Refer to Study Guide for:

- Week 3 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 3

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Continue working on the Practical Assessment 1 Part 1 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

Module/Topic

Taxation Fundamentals

- Income and capital gains tax basics

- Applying tax effective strategies to personal financial planning

- Taxation implications on investment returns, including capital gains

- Taxation implications of income splitting

- Identifying the various taxable entities with their benefits and shortcomings

- Explain the concept of negative gearing

- Discuss remuneration planning like salary packaging its tax implications

- Fringe Benefit Tax

- Goods and Services Tax

Chapter

Refer to Study Guide for:

- Week 4 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 4

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Continue working on the Practical Assessment 1 Part 1 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

Module/Topic

Identifying Investment Choices

- Attributes of investors

- Investment asset classes

- Risk and return relationship

- Benefits of diversification

- Understanding general investment strategies

Chapter

Refer to Study Guide for:

- Week 5 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 5

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Continue working on the Practical Assessment 1 Part 1 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

Module/Topic

Vacation and Catchup Week

Chapter

Refer to Study Guides Weeks 1 to 5

Events and Submissions/Topic

- Catch up incomplete Study Guides and Workbooks from Weeks 1 to 5

- Catch up on Zoom workshop recordings

- Finalize Practical Assessment 1 Part 1 of 2 ready for submission next week

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Watch online Zoom workshop recording/s missed

Module/Topic

Wealth Creation 1: Direct Investment in Fixed Interest, Shares and Property

- Characteristics, benefits, risks and impact of interest rate changes on cash, fixed interest, shares and property investments

- Valuations and structuring a direct investment strategy in shares, property, collectibles and alternative investments

Chapter

Refer to Study Guide for:

- Week 6 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 6

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Submit your Practical Assessment 1 Part 1 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

[SCALED] STATEMENT OF ADVICE PART 1 of 2 Due: Week 6 Monday (15 Apr 2024) 11:45 pm AEST

Module/Topic

Wealth Creation 2: Managed Funds, Gearing and Margin Lending

- Asset Classes - cash, fixed interest, shares, ETFs and property investments

- Benefits, risks, fee structures and taxation implications of managed fund, leveraged investment and margin lending strategy

- Researching and Identifying management and investment styles of fund managers

- Constructing a managed fund and geared investment strategies

Chapter

Refer to Study Guide for:

- Week 7 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 7

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Start the Practical Assessment 1 Part 2 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

Module/Topic

Wealth Protection: Insurance and Risk Management

- Classifications of risk and risk management

- Insurance concepts, policy types and conditions

- Evaluating personal and property risk

- Purchasing personal insurance inside versus outside superannuation,

- Lifestyle changes and the need for ongoing review

Chapter

Refer to Study Guide for:

- Week 8 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 8

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Continue working on the Practical Assessment 1 Part 2 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

Module/Topic

Wealth Creation 3: Superannuation

- Characteristics, types and structure of superannuation trusts, investment and product

- Employer, employee contributions, tax treatments and preservation rules

- Basic superannuation accumulation strategies

Chapter

Refer to Study Guide for:

- Week 9 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 9

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Continue working on the Practical Assessment 1 Part 2 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

Module/Topic

Retirement Planning

- Conditions of release

- Preservation age

- Withdrawal of funds

- Death benefit basics

"HAVE YOUR SAY" Student Evaluation Survey

Chapter

Refer to Study Guide for:

- Week 10 Prescribed and Supplementary Reading

- Final Exam Advice available by Week 10

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 10

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Continue working on the Practical Assessment 1 Part 2 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

Module/Topic

Social Security

- Government benefits

- Age and DVA pension entitlements

- Income and asset test calculations

"HAVE YOUR SAY" Student Evaluation Survey

Chapter

Refer to Study Guide for:

- Week 11 Prescribed and Supplementary Reading

- Final Exam Advice available by Week 10

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 11

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Submitted the finalised Practical Assessment 1 Part 2 of 2

- Engage on Moodle Q&A forum to address any concerns or queries

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

[SCALED] STATEMENT OF ADVICE PART 2 of 2 Due: Week 11 Monday (20 May 2024) 11:45 pm AEST

Module/Topic

Fundamentals of Estate Planning Estate Planning

- Importance and critical components of estate planning in a financial plan

- Distribution of estate and non-estate assets

- Raising the question of estate planning with a client

Final Exam Review

"HAVE YOUR SAY" Student Evaluation Survey

Chapter

Refer to Study Guide for:

- Week 12 Prescribed and Supplementary Reading

- Final Exam Advice

Events and Submissions/Topic

- Work through the 'Study Guide' for Week 12

- Watch the Lecture recording before the Workshop

- Attend (preferred) or watch the recording of the Zoom Workshop

- Complete the 'Workbook' for Week 1

- Start preparing for the 2 hour Examination

- Engage on Moodle Q&A forum to address any concerns or queries

- Complete the Student Evaluations

Note: Zoom Workshop link available in <Classes and Recordings> tile

- Attend/watch online Zoom workshop recording

Module/Topic

Exam preparation and exam week

Completion of Student Evaluation Survey

Chapter

Refer to Study Guides for:

- Weeks 1 to 12

Events and Submissions/Topic

- All the best for the exams this week.

- Refer to Previous Exam Papers available on Moodle

- If you have not already done so, complete "Have Your Say" Survey

EXAMINATION Due: Review/Exam Week Wednesday (5 June 2024) 4:00 pm AEST

Module/Topic

Reports

Chapter

Refer to <Closure and Reports> tile for:

- Reports finalized by the various relevant committees of CQU SBL

Events and Submissions/Topic

- End of term reports available on the Moodle and after Certification of Grades

1 Practical Assessment

This is an individual assessment comprising two parts.

This assessment is the Practical Assessment 1 Part 1 of 2

You will achieve the following Unit Learning Outcomes with this assessment:

- Present strategic advice which meets the financial planning needs and objectives of clients in a variety of circumstances.

- Communicate effectively with clients to solve financial planning problems.

- Construct financial planning scenarios using industry standard software.

Comprehensive guidelines, submission instructions, resources and marking criteria will be available in Moodle in the <ASSESSMENT> tile.

In summary:

- You will be provided with a client case study and a partially completed Statement of Advice template.

- The purpose of this assignment is to have you research a personal budgeting and debt management problem, analyse a number of solutions and document your recommendations using a simulated real-world financial planning advice template.

- The Statement of Advice template completion is a simulation of the real-world and contains specific justifications related to your financial planning recommendations. Hence, this assignment has the reputation for being challenging, yet useful in terms of how it builds financial planning knowledge as well as provides employable skills.

- Weekly Zoom Workshops will demonstrate how to construct a Statement of Advice from different perspectives.

Engaging with your peers via the Moodle Q&A forum helps lighten your study workload and address any matters around the Assessment tasks.

Week 6 Monday (15 Apr 2024) 11:45 pm AEST

All activities must be completed and submitted via Moodle

Week 8 Monday (29 Apr 2024)

Grades and feedback will be provided via Moodle in the

Details of the marking criteria (rubrics) is provided in Moodle in the <ASSESSMENT> tile.

Use the marking rubrics as a checklist.

We award marks for submitting a completed work integrated learning Statement of Advice (SOA) Microsoft-Word template provided covering the following sections of the SOA:

- Introduction (Table of Contents)

- Are you on Track

- Summary of our Advice in a Strategy Map

- Our Recommended Strategies

- Our Product Recommendations

- Replacement and alternative product recommendations included

- Explain and apply the process and Australian legal framework of financial planning.

- Present strategic advice which meets the financial planning needs and objectives of clients in a variety of circumstances.

- Communication

- Problem Solving

- Critical Thinking

- Information Literacy

- Team Work

- Information Technology Competence

2 Practical Assessment

This is the continuation of the practical work integrated learning assessment.

This individual assessment is the Practical Assessment 1 Part 2 of 2.

With this assessment you will achieve the following Unit Learning Outcomes:

- Present strategic advice which meets the financial planning needs and objectives of clients in a variety of circumstances.

- Communicate effectively with clients to solve financial planning problems.

- Construct financial planning scenarios using industry standard software.

Comprehensive guidelines, submission instructions, resources and marking criteria will be available in Moodle in the <ASSESSMENT> tile.

In summary:

- You will continue with the client case study provided in Part 1 of 2 and continue completing the partially completed Statement of Advice template.

- The purpose of this assignment is to have you work on the projected financial outcomes of the personal budgeting and debt management problem and complete and finalize the Statement of Advice document into a professional document ready to present to a client.

- Weekly Zoom Workshops will continue to demonstrate how to finalize this Statement of Advice from different perspectives.

Engaging with your peers via the Moodle Q&A forum helps lighten your study workload and address any matters around the Assessment tasks.

Week 11 Monday (20 May 2024) 11:45 pm AEST

Refer to submission instructions in Moodle

Week 12 Friday (31 May 2024)

Feedback will be provided via Moodle in the

Details of the marking criteria (rubrics) is provided in Moodle in the <ASSESSMENT> tile.

Use the marking rubrics as a checklist.

We award marks for completing a work integrated learning Statement of Advice (SOA) Microsoft-Word template provided covering the following sections of the SOA.

- Financial outcomes of our recommended strategies

- Cost of our advice

- Supporting information and Annexures

- Organisation/Structure/Presentation/Mechanics

- Sources/Evidence

- Engagement on Moodle Q&A Forum

- Explain and apply the process and Australian legal framework of financial planning.

- Present strategic advice which meets the financial planning needs and objectives of clients in a variety of circumstances.

- Communicate effectively with clients to solve financial planning problems.

- Construct financial planning scenarios using industry standard software.

- Communication

- Problem Solving

- Critical Thinking

- Information Literacy

- Team Work

- Cross Cultural Competence

- Ethical practice

3 Take Home Exam

This is an open book online timed exam of 2 hours, including downloading, uploading and submission time.

This assessment aims to achieve the following Unit Learning Outcomes:

- Present strategic advice which meets the financial planning needs and objectives of clients in a variety of circumstances.

- Communicate effectively with clients to solve financial planning problems.

- Explain and apply the process and Australian legal framework of financial planning.

The requirements of this assessment include:

- There is a minimum exam grade of 50% to pass the unit.

- You will be typing your answers in the examination template document provided.

- This is an individual assessment. Collaboration with other students will result in an academic misconduct allegation for all students involved. This may result in a fail result for this assessment. Please note that your paper will be submitted through Turnitin.

- You have 15 minutes at the start of the exam to download the exam file via Moodle.

- You have 1.5 hours to complete the exam in Microsoft-Word.

- You have 15 minutes to upload and submit the completed examination paper at the end of 1.5 hours.

- Late submissions will not be marked.

- If you encounter problems submitting your paper to Moodle, email it to your unit coordinator by the due time.

Review/Exam Week Wednesday (5 June 2024) 4:00 pm AEST

Download the exam from Moodle Assessment tile on the scheduled date and time.

Exam Week Wednesday (12 June 2024)

Feedback will be provided via Moodle in the Assessment tile on Certification of Grades date

Open book online exam grading as per the Online Take Home Exam Advice to meet the unit learning outcomes:

- Explain and apply the process and Australian legal framework of financial planning

- Present strategic advice which meets the financial planning needs and objectives of clients in a variety of circumstances.

- Communicate effectively with clients to solve financial planning problems.

There are eight 5 mark short answer applied theory questions.

Refer to the Exam Advice and Online Open Book Exam Instructions

- Explain and apply the process and Australian legal framework of financial planning.

- Present strategic advice which meets the financial planning needs and objectives of clients in a variety of circumstances.

- Communicate effectively with clients to solve financial planning problems.

- Construct financial planning scenarios using industry standard software.

- Communication

- Problem Solving

- Critical Thinking

- Information Literacy

- Cross Cultural Competence

- Ethical practice

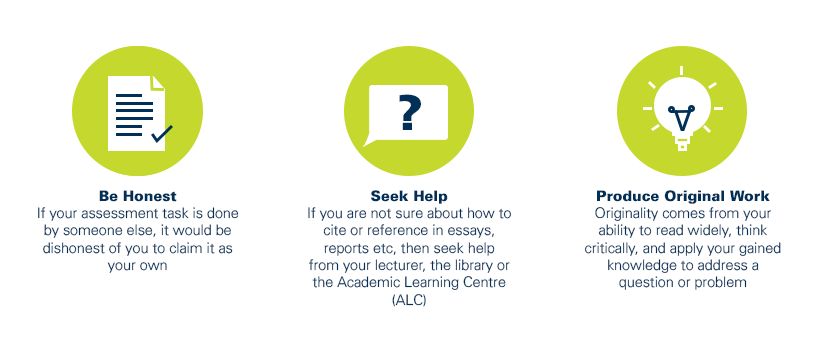

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?