Overview

The Constitution and taxation power; the taxing formula; the concept, source and derivation of income at ordinary concepts; exempt income; non-assessable non-exempt income; allowable deductions; tax rates, tax offsets and levies; statutory inclusions in income including capital gains, trading stock; fringe benefits tax; goods and services tax; taxation of companies; partnerships and trusts; administrative provisions.

Details

Pre-requisites or Co-requisites

Prerequisite (ACCT11059 or ACCT11057) and (LAWS11030 or LAWS19031 or LAWS11054)

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 2 - 2024

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Undergraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from Comments during the workshop where practical issues in taxation are discussed together with the workshop questions.

Students have appreciated the practical approach being taken in the teaching of taxation law.

Maintaining this approach. It means that by using practical case studies which reflect the real-world experience, AI should have no impact as each question every term is different and all requiring calculation of taxable income and tax payable by individuals and companies.

- Describe at a basic level the Australian income taxation system

- Explain the main concepts and principles of Australian income taxation law

- Apply taxation laws and prepare income tax returns of moderate complexity for individual taxpayers, companies, partnerships and trusts

- Discuss a range of other taxes in the Australian taxation regime, including fringe benefits tax and goods and services tax.

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Online Quiz(zes) - 10% | ||||

| 2 - Case Study - 40% | ||||

| 3 - Online Test - 50% | ||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Communication | ||||

| 2 - Problem Solving | ||||

| 3 - Critical Thinking | ||||

| 4 - Information Literacy | ||||

| 5 - Team Work | ||||

| 6 - Information Technology Competence | ||||

| 7 - Cross Cultural Competence | ||||

| 8 - Ethical practice | ||||

| 9 - Social Innovation | ||||

| 10 - Aboriginal and Torres Strait Islander Cultures | ||||

Textbooks

Principles of Taxation Law 2024

Edition: 2024 (2024)

Authors: Sadiq et al

Thomson Reuters

Sydney Sydney , NSW , Australia

ISBN: 9780455248110

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

All submissions for this unit must use the referencing style: Australian Guide to Legal Citation, 4th ed

For further information, see the Assessment Tasks.

j.mclaren@cqu.edu.au

Module/Topic

Introduction to taxation law in Australia

Chapter

Principles of Taxation Law 2023 - Chapters 1 and 3

Events and Submissions/Topic

End of chapter questions

Module/Topic

Residence of the taxpayer and source of income

Chapter

Principles of Taxation Law - chapter 2

Events and Submissions/Topic

End of chapter questions

Module/Topic

Assessable income - Ordinary income from personal services and employment, income from business and income from property.

Chapter

Principles of Taxation Law - Chapters 5,6,8,and 9

Events and Submissions/Topic

End of chapter questions

Module/Topic

General Deductions

Chapter

Principles of Taxation Law - Chapter 12

Events and Submissions/Topic

End of chapter questions

Module/Topic

Specific Deductions and Capital Allowances

Chapter

Principles of Taxation Law - Chapters 13 and 14.

Events and Submissions/Topic

End of chapter questions

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Taxation of Capital Gains and Trading Stock

Chapter

Principles of Taxation Law - Chapters

Events and Submissions/Topic

End of chapter questions

Module/Topic

Offsets and Tax Accounting

Chapter

Principles of Taxation Law - Chapters 15 and 16.

Events and Submissions/Topic

End of chapter questions

Module/Topic

Taxation of Companies and Shareholders and Superannuation

Chapter

Principles of Taxation Law - Chapters 18 and 21.

Events and Submissions/Topic

End of chapter questions

Module/Topic

Partnerships and Partners and Trusts and Beneficiaries

Chapter

Principles of Taxation Law - Chapters 19 and 20.

Events and Submissions/Topic

End of chapter questions

Module/Topic

Tax Administration and Tax Avoidance

Chapter

Principles of Taxation Law - Chapters 23 and 24.

Events and Submissions/Topic

End of chapter questions

Module/Topic

Fringe Benefits Tax (FBT)

Chapter

Principles of Taxation Law - Chapter 11.

Events and Submissions/Topic

End of Chapter questions

Module/Topic

Goods and Services Tax (GST)

Chapter

Principles of Taxation Law - Chapter 25.

Events and Submissions/Topic

End of chapter questions.

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Online end of term quiz

Chapter

Events and Submissions/Topic

1 Online Quiz(zes)

The MCQ test will cover topics from weeks 1 to 3. It will be online and students have 30 minutes to complete the test.

1

Other

The online test must be completed within 30 minutes

The mark will be shown in the grade book

There will be 10 multiple choice questions covering the content in weeks 1 to 3.

- Describe at a basic level the Australian income taxation system

- Explain the main concepts and principles of Australian income taxation law

- Apply taxation laws and prepare income tax returns of moderate complexity for individual taxpayers, companies, partnerships and trusts

2 Case Study

There will be two (2) case study questions each worth 20 marks with a total of 40 marks. The details will be available in Moodle.

answers to be submitted in Moodle

mark will be available in Moodle together with feedback

The two case studies will be based on material covered in weeks 1 to 6. Details will be available in Moodle.

- Describe at a basic level the Australian income taxation system

- Explain the main concepts and principles of Australian income taxation law

- Apply taxation laws and prepare income tax returns of moderate complexity for individual taxpayers, companies, partnerships and trusts

- Discuss a range of other taxes in the Australian taxation regime, including fringe benefits tax and goods and services tax.

3 Online Test

The end of term quiz will cover all topics from weeks 1 to 12. The quiz will consist of short calculation questions and MCQ.

The end of term quiz will test knowledge and the practical application of the areas of taxation law covered in this unit.

- Describe at a basic level the Australian income taxation system

- Explain the main concepts and principles of Australian income taxation law

- Apply taxation laws and prepare income tax returns of moderate complexity for individual taxpayers, companies, partnerships and trusts

- Discuss a range of other taxes in the Australian taxation regime, including fringe benefits tax and goods and services tax.

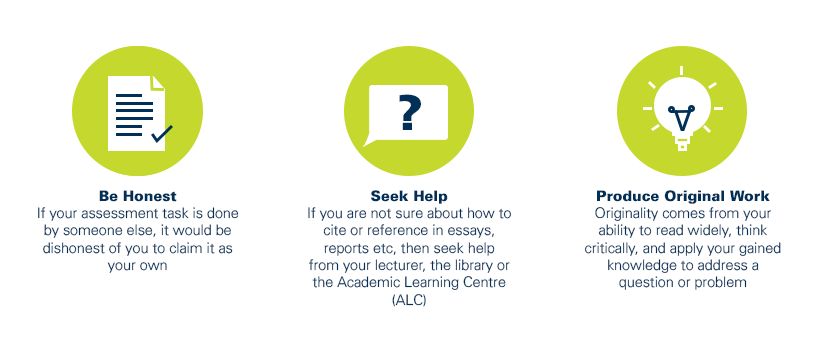

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?