Overview

This unit provides a fundamental understanding of management finance. You will examine corporate financial goals and how to realise them through the raising of funds, the allocation of resources and the undertaking of investments by firms. You will be introduced to the theory and use of a range of financial decision making concepts such as financial goals, financial markets, financial mathematics, risk and return, asset pricing, capital budgeting, cost of capital, capital structure and dividend policy.

Details

Pre-requisites or Co-requisites

There are no requisites for this unit.

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 1 - 2025

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Postgraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from Unit Evaluation

I really enjoyed the assignments for this course. They were real-world oriented, practical and I learnt a lot from them.

The assessment questions are based on real-world case studies. All the assessments have been discussed in class with a clear expectation conveyed to students. The workshop sessions have been also recorded and uploaded on the Moodle to ensure that students have access to information and guidelines in preparing their assessments.

Feedback from Unit Evaluation

I genuinely don't have any finance background, I find it a bit challenge for me.

The teaching team has focused on the areas that students may find challenging and spent more time in workshops to reinforce finance concepts and terminologies using exercise questions and case studies. The approach works well for students from non-accounting and finance background.

Feedback from Unit Evaluation

If on-campus classes are taken before 5pm it would be nice.

Some classes run after 5pm, students may find fatigue after a long day in the campus. The classes are scheduled according to the university’s timetabling, we may need to have another look the timetable to accommodate.

- Examine and describe financial goals and their realisation in the context of modern firms and financial managers

- Analyse the role of financial markets and their functions in a developed economy

- Evaluate various capital assets and funding strategies

- Evaluate corporate financial decisions related to capital structure and dividend policy aimed at maximising the value of the firm.

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Written Assessment - 20% | ||||

| 2 - Practical and Written Assessment - 30% | ||||

| 3 - Online Test - 50% | ||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Knowledge | ||||

| 2 - Communication | ||||

| 3 - Cognitive, technical and creative skills | ||||

| 4 - Research | ||||

| 5 - Self-management | ||||

| 6 - Ethical and Professional Responsibility | ||||

| 7 - Leadership | ||||

| 8 - First Nations Knowledges | ||||

| 9 - Aboriginal and Torres Strait Islander Cultures | ||||

Textbooks

Financial Management: Principles and Applications

Edition: 8th (2019)

Authors: Titman, S; Martin, T; Keown, A.J.; Martin, J.D.

Pearson Australia

Melbourne Melbourne , Victoria , Australia

ISBN: 9781488617218

Binding: Hardcover

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

- Microsoft Office (Word, Excel, PowerPoint) or similar

- GenAI (ChatGPT) or similar

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

l.sun@cqu.edu.au

Module/Topic

Getting started -Principles of finance

Firms and the financial markets

Chapter

1 and 2

Events and Submissions/Topic

Module/Topic

Understanding financial statements, taxes and cash flows

Financial analysis - Sizing up firm performance

Chapter

3 and 4

Events and Submissions/Topic

Module/Topic

The time value of money - The basics

The time value of money - Annuities and other topics

Chapter

5 and 6

Events and Submissions/Topic

Module/Topic

An introduction to risk and return

Risk and return- Capital market theory

Chapter

7 and 8

Events and Submissions/Topic

Module/Topic

Debt valuation and interest rates

Chapter

9

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Share valuation

Chapter

10

Events and Submissions/Topic

Module/Topic

Investment decision criteria

Analysing project cash flows

Chapter

11 and 12

Events and Submissions/Topic

Module/Topic

Risk analysis and project evaluation

Chapter

13

Events and Submissions/Topic

Module/Topic

The cost of capital

Chapter

14

Events and Submissions/Topic

Module/Topic

Capital-structure policy

Chapter

16

Events and Submissions/Topic

Module/Topic

Dividend policy

Chapter

17

Events and Submissions/Topic

Module/Topic

Revision

Chapter

All chapters

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

1 Written Assessment

For Assessment 1, the task includes calculation and theory questions. Specific instructions and the marking criteria will be posted on the Moodle site. Importantly, working in a group promotes collaborative learning and knowledge sharing to enhance the learning experience.

In summary key expectations include:

- students are encouraged to include tables, figures and appendices to support answers.

- all content [including the narrative, diagrams, figures, tables and appendices] must be referenced using APA reference formatting.

- do not include any jpeg/jpg files or similar scanned picture files of your answers or those of other students.

- Only provide images (jpeg/jpg/or similar) of pictures, figures or tables sourced from references that you are unable to adapt or modify in MS-word for purposes of your assessments. Make sure you reference the sources of any images correctly.

- type in all your formulas using the <Insert> <Equation>function in the Microsoft-word application and include citation as a footnote for formulas or as an in-text reference citation or you risk high similarity.

- create your own timelines in Microsoft-word or Microsoft-excel or similar applications. Do not copy and paste timelines from any website, other students' papers or other sources.

- to demonstrate your research skills, answers to theory questions should draw supporting evidence and include peer-reviewed references.

- submission is online via Moodle in Word format only (.doc or .docx). Do not upload your assignment in PDF format.

- use AI tools to assist with tasks such as generating ideas, drafting text, planning, refining the work, critically evaluate and modify any AI-generated content and acknowledge the use of AI.

This assessment requires students to adhere to the guidelines on the use of artificial intelligence tools as specified in the Artificial Intelligence Assessment Scale (AIAS). Any misuse or lack of disclosure regarding the use of AI tools will be considered a breach of academic integrity.

Week 5 Friday (11 Apr 2025) 11:55 pm AEST

Online submission through Moodle

Week 7 Friday (2 May 2025)

Feedback to be advised in Moodle and in workshop

Along with task instructions and questions, a marking rubric/mark sheet is provided on Moodle.

IMPORTANT NOTE 1: For calculation questions, full marks will only be awarded when the answer is accurate, the right formula is used AND all calculation steps, applicable diagrams/figures/tables/timelines are shown.

IMPORTANT NOTE 2: For theory questions, the minimum standards include clear and correct explanations, using your own words and adherence to APA referencing formats.

- Examine and describe financial goals and their realisation in the context of modern firms and financial managers

- Analyse the role of financial markets and their functions in a developed economy

- Evaluate various capital assets and funding strategies

- Evaluate corporate financial decisions related to capital structure and dividend policy aimed at maximising the value of the firm.

2 Practical and Written Assessment

For Assessment 2, the assessment centers around a case study which requires research and application of the theories, concepts and techniques that are needed to make financial decisions in real business environments. Specific instructions and a marking criteria will be posted on the Moodle site. The assessment also gives students the opportunity to collaborate and work as a team.

In summary the key expectations are:

- response to case study must be in report format, also see the marking criteria on Moodle for full instructions.

- inclusion of diagrams and tables to support the response is strongly encouraged.

- all supporting material, diagrams and tables must be properly referenced using APA in-text referencing formats.

- type in all your formulas using the <Insert> <Equation>function in the Microsoft-word application and include citation as a footnote for formulas or as an in-text reference citation or you risk high similarity.

- create your own financial analysis in Microsoft-word or Microsoft-excel application. Do not copy and paste financial analysis from any website, other students' papers or other sources, or you risk high similarity.

- support for the response should draw from a minimum of 12 different peer-reviewed academic references as well as a range of appropriate web-based internet and/or professional texts and sources.

- submission is online via Moodle in Word format (.doc or .docx).

- use AI tools to assist with tasks such as generating ideas, drafting text, planning, refining the work, critically evaluate and modify any AI-generated content and acknowledge the use of AI.

This assessment requires students to adhere to the guidelines on the use of artificial intelligence tools as specified in the Artificial Intelligence Assessment Scale (AIAS). Any misuse or lack of disclosure regarding the use of AI tools will be considered a breach of academic integrity.

Week 9 Friday (16 May 2025) 11:55 pm AEST

Online submission through Moodle

Week 12 Friday (6 June 2025)

Feedback to be advised in Moodle and in workshop

Along with task instructions and questions, a marking rubric/mark sheet is provided on Moodle.

The assignment is designed to assess the understanding of business finance theories and explores a number of areas within the course by applying the classroom learning to a real company. Through this project, the student needs to demonstrate critical and analytical skills in academic writing, various research synthesizing skills and be able to communicate clearly and effectively. This is a finance assignment for real business, so the combination of quantitative and qualitative analysis is the key.

IMPORTANT NOTE: the minimum standards include clear and correct explanations, using your own words and adherence to APA referencing formats.

- Evaluate various capital assets and funding strategies

- Evaluate corporate financial decisions related to capital structure and dividend policy aimed at maximising the value of the firm.

3 Online Test

This is an open-book take-home exam or online test. If students encounter problems in submitting the attempt to Moodle, they need to email the unit coordinator as soon as possible. This is an individual assessment. Collaboration with other students will result in an academic misconduct allegation for all students involved. This may result in a failure result for this assessment. This assessment requires students to adhere to the guidelines on the use of artificial intelligence tools as specified in the Artificial Intelligence Assessment Scale (AIAS). Any misuse or lack of disclosure regarding the use of AI tools will be considered a breach of academic integrity. More information will be advised in Moodle.

Online submission through Moodle during the formal exam period

To be advised in Moodle

The online test assesses the students' knowledge and understanding of managerial finance theories/concepts. The test also determines the students' ability to assess the importance of finance and risk, and allows the students to demonstrate their understanding of advance theoretical and practical knowledge relevant to corporate finance. Students demonstrate their comprehension of finance theories/concepts through the critical analysis of hypothetical business finance scenario problems and the use of basic financial mathematics to solve practical questions and deliver accurate outcomes.

The Assessment Criteria will include:

- Relevance to the questions.

- Accuracy of information/argument and calculations.

- Clarity of expression.

- Demonstrated links to corresponding readings.

- Examine and describe financial goals and their realisation in the context of modern firms and financial managers

- Analyse the role of financial markets and their functions in a developed economy

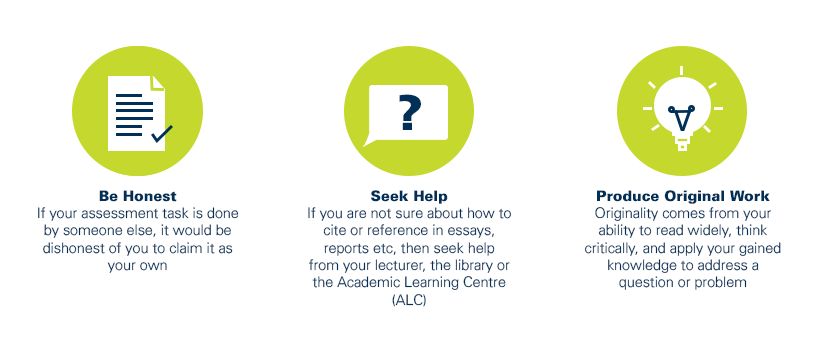

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?