Overview

This capstone unit applies prior knowledge to produce a statement of advice for a real world case study. You will conduct an initial client interview, research and develop a wealth strategy and learn to present a financial plan to a client. You also gain insights into management of client relationships.

Details

Pre-requisites or Co-requisites

Pre-requisites - FINC11001 and FINC19011 and LAWS19033 Co-requisites:- FINC19012 and FINC19016 and FINC13001

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 2 - 2025

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Undergraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from Feedback given by the Student in the form of MyExperience responses.

On the 2 August and 26 August a student gave the following satisfaction scores with the unit, 7 and 8 respectively.

Continue to improve this unit requirements and feedback to meet student expectations

Feedback from Recommendations by Learning Design & innovation team, discussions with Discipline colleagues from the Economics, Finance, Property Disciplines

Low content engagement, especially pre-recorded content video recordings because they are considered too long

"Chunking" video recordings by topic instead of one long pre-recorded content video

Feedback from Student Evaluations

Usefulness of Assessment Feedback is not to student satisfaction

Train staff to provide more useful assessment feedback.

- Research and identify client data in developing a statement of advice

- Apply professional and ethical principles pertaining to the financial planning process

- Employ communication skills to manage client relationships

- Apply financial planning software to model client scenarios.

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Practical Assessment - 30% | ||||

| 2 - Practical Assessment - 40% | ||||

| 3 - Practical Assessment - 30% | ||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Communication | ||||

| 2 - Problem Solving | ||||

| 3 - Critical Thinking | ||||

| 4 - Information Literacy | ||||

| 5 - Team Work | ||||

| 6 - Information Technology Competence | ||||

| 7 - Cross Cultural Competence | ||||

| 8 - Ethical practice | ||||

| 9 - Social Innovation | ||||

| 10 - First Nations Knowledges | ||||

| 11 - Aboriginal and Torres Strait Islander Cultures | ||||

Alignment of Assessment Tasks to Graduate Attributes

| Assessment Tasks | Graduate Attributes | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

| 1 - Practical Assessment - 30% | |||||||||||

| 2 - Practical Assessment - 40% | |||||||||||

| 3 - Practical Assessment - 30% | |||||||||||

Textbooks

There are no required textbooks.

Additional Textbook Information

There will be no prescribed textbook for this unit.

Students are encouraged to refer to prescribed textbooks and resources they used in previous financial planning units, like

- FINC11001 Fundamentals of Personal Financial Planning

- FINC19012 Investment Analysis and Risk Management

- FINC19016 Retirement and Superannuation

- FINC19019 Insurance Planning.

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

- Financial Planning Software

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

a.mcinnes@cqu.edu.au

Module/Topic

Professional Obligations of a Financial Adviser and Providing Advice

- Legislative and Compliance Frameworks Governing the Provision and Construction of the Statement of Advice [SoA] (Financial Plan)

- Fiduciary Obligations, Financial Adviser Codes of Ethics and Best Interest Duties

Chapter

- Refer Study Guide for Week 1

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 1 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

Module/Topic

Overview of the Statement of Advice Development and Construction Process

- The Financial Planning Process: 6 Steps - Objectives, Intentions and Compliance

- Examining Financial Plan Exemplars and Templates

Chapter

- Refer Study Guide for Week 2

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 2 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

Module/Topic

Gathering and Analyzing Client Data and Tax Position

- Articulating the Client's Goals and Concerns, Preferences and Time Horizons

- Identifying the Strengths and Weaknesses of the Client's Financial Position

- Establishing the Client's Risk Tolerance, Risk Capacity, Liquidity, Budgets, Debt and Tax Position

- Budgeting (Cashflow) and Personal Debt Management Recommendations

Chapter

- Refer Study Guide for Week 3

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 3 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

Module/Topic

Wealth Protection 1: Analyzing the Client's Insurance and Estate Planning Risks

- Conduct an Insurance and Estate Planning Needs Analysis

- Assessing the Suitability and Appropriateness of the Client's Insurance Cover, Policy Type and Ownership.

- Articulate the Critical Estate Planning Needs

Chapter

- Refer Study Guide for Week 4

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 4 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

Module/Topic

Wealth Protection 2: Developing and Constructing Wealth Protection Advice

- Applying Best Interest Duty and Matching Client Needs with Appropriate Insurance Polices

- Using financial planning software to Select and Compare Insurance Policies

- Product Replacement Essentials, Benefits and Risks

- Building Support and Articulating the Justifications for the Insurance Recommendations

Chapter

- Refer Study Guide for Week 5

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 5 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

Module/Topic

Vacation and Catch-up Week

Chapter

- Weeks 1 to 5 Study Guides

- Weeks 1 to 5 Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

- Weeks 1 to 5 Study Guides and Content

- Assessment Completion

- Catching up Incomplete Modules from Weeks 1 to 5

Module/Topic

Wealth Creation 1: Analyzing [Non-Super] Short and Medium-Term Investments Options

- Constructing Short and Medium-term Investment Advice using Non-super Investment Strategies and Products

- Using Financial Planning Software to Select and Compare the Characteristics of Cash, Real Estate Investment Trusts, Fixed Interest, Exchange Traded Funds and Managed Fund Investments

- Matching Client Objectives to Non-super Investments Strategies

- Building Support and Articulating the Justifications for the Non-super Investment Recommendations

Chapter

- Refer Study Guide for Week 6

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 6 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

STATEMENT OF ADVICE PART 1 of 2 Due: Week 6 Monday (25 Aug 2025) 11:45 pm AEST

Module/Topic

Wealth Creation 2: Analyzing [Super] Long Term Investment Options

- Review Current Superannuation Contribution Legislation and Tax Treatments

- Aligning Superannuation Recommendations with the Client's Needs, Objectives, Risk Tolerance and Risk Capacity

- Developing Long Term and Tax Effective Wealth Accumulation Superannuation Strategies

- Using Financial Planning Software to Select and Compare Superannuation Products

- Rebalancing the Super Asset Allocation to Align with a Client's Risk Profile

- Building Support and Articulating the Justifications for the Super Recommendations

Chapter

- Refer Study Guide for Week 7

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 7 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

Module/Topic

Wealth Creation 3: Evaluating Portfolios

- Aligning and Re-aligning a Managed Fund Portfolio with a Client's Risk Tolerance

- Using Financial Planning Software to Select and Evaluate Appropriate Managed Funds and or Exchange Traded Funds

- Rebalancing the Non-super Investment Asset Allocation to Align with a Client's Risk Profile

- Building Support and Articulating the Justifications for the Investment Recommendations

Chapter

- Refer Study Guide for Week 8

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 8 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

Module/Topic

Finalizing the Statement of Advice [SoA](Financial Plan)

- Refining and Producing a Professional and Compliant SoA (Financial Plan)

- Creating Strategy Maps

- Clarifying Disclosure and Scope of the Advice

- Thinking Ahead to the SoA (Financial Plan) Presentation

Chapter

- Refer Study Guide for Week 9

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 9 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

Module/Topic

Managing the Client Relationship 1: Initial Phase

- Conducting Effective Client Interviews

- Questioning and Framing Techniques

- Making the Connection between the Adviser Codes of Ethics, Professional Conduct Obligations and 'Know Your Client' Rule

- Complete the Student Evaluation Survey

Chapter

- Refer Study Guide for Week 10

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 10 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

STATEMENT OF ADVICE PART 2 of 2 Due: Week 10 Monday (22 Sept 2025) 11:45 pm AEST

Module/Topic

Managing the Client Relationship 2: Presenting the Advice

- Customizing the SoA (Financial Plan) Presentation to the Client

- Organizing the SoA (Financial Plan) Implementation Documentation

- Discussing Fees and Costs

- Complete the Student Evaluations Survey

Chapter

- Refer Study Guide for Week 11

- Prescribed Reading and Supplementary Reading

Events and Submissions/Topic

Refer to Week 11 in Moodle for:

- Study Guide

- Overheads

- Online Live Zoom Workshop

- Weekly Workbook

- Online Zoom Workshop Recordings

Module/Topic

SoA (Financial Plan) Presentations Conducted in this week.

- Unit Revision

- Complete the Student Evaluation Survey

Chapter

Refer to Week 12 in Moodle for:

- Exemplars of SoA (Financial Plan) Presentations

- SoA (Financial Plan) Presentation Templates

Events and Submissions/Topic

Refer to Week 12 in Moodle for:

- SoA (Financial Plan) Presentation Schedules

- Other instructions

Statement of Advice Presentation Due: Week 12 Friday (10 Oct 2025) 11:45 pm AEST

Module/Topic

- Complete the Student Evaluation Survey

Chapter

Events and Submissions/Topic

- Complete the Student Evaluation Survey

Module/Topic

Wishing You All the Best with Your Future Careers

Chapter

Events and Submissions/Topic

Unit Coordinator End of Term Report

- Available once Finalized by all the Relevant Committees and Certification of Grades

Refer back to previous financial planning units and make use of all the resources from these units to complete your assessment task:

- FINC11001 Fundamentals of Personal Financial Planning

- FINC19012 Investment Analysis and Risk Management

- FINC19016 Retirement and Superannuation

- FINC19019 Insurance Planning

- FINC13001 Estate Planning

Look back at the feedback provided in these units' SOA assessments so you do not make the same mistakes again.

1 Practical Assessment

Assignment Instructions: Comprehensive Statement of Advice (SOA) - Part 1

Overview:

This assignment is a group project, allowing groups of 1, 2, or 3 students to collaborate.

Teaching and Assessment Approach

The teaching approach of this unit is based on experiential simulated work-integrated learning using case studies.

Experiential Learning Theory was developed by David Kolb where students learn through experience, reflection, conceptualization, and experimentation.

This theory emphasizes learning through experience, reflecting on those experiences, so the student can apply a simulation of the real world and what is learned to their future role as financial adviser.

Using a client case study the student is expected to complete a partially completed financial plan focused on budgeting, personal debt management, super and non-superannuation investment strategies, and insurance planning strategies and their related product recommendations for a couple.

This assessment allows the student to engage with a real-world detailed case study, and help the client achieve their financial planning goals using different comprehensive advice strategies and real-world financial planning products. Not only do the student learn new knowledge but learn to apply the newly acquired knowledge to the case study.

Combining the case study with a simulated work-integrated approach gives students hands-on experience of what it is like to work in a professional practical setting, dealing with a simulated real-world task of completing a comprehensive financial plan through experimenting with strategies and solutions based on their previous learning from pervious units.

Instructions:

Detailed guidelines, submission procedures, resources, and grading criteria are accessible on Moodle under the <ASSESSMENT> tile.

In summary, your task is to complete the initial segment of a Comprehensive Statement of Advice.

Client Details:

Client information will be extracted from a Pre-populated Fact Find.

Objective:

Developing a comprehensive Statement of Advice (Financial Plan) provides a valuable opportunity to integrate your technical expertise from previous financial planning units with your communication abilities within a simulated real-world context.

Submission Schedule:

1. Part 1 of 2: Due in Week 6 for grading

2. Finalized Part 2 of Part 2 (Final completed SOA): Due in Week 10 for grading

Submission Guidelines:

Part 1 Submission:

- Your Part 1 submission must be uploaded to Moodle by the Week 6 deadline.

- Part 1 must be fully upon submission. Refer to the rubrics for guidelines of what to submit for Part 1.

- Note: Part 1 will be graded separately from Part 2. However, Part 2 must flow from Part 1.

Part 2 Submission:

The finalized entire financial plan (SOA), incorporating both Part 1 and Part 2, must be submitted by the Week 10 deadline. Only Part 2 will be graded, but Part 1 and 2 must flow sequentially and make sense.

Rationale:

Splitting the SOA Assessment into two parts aims to foster progressive learning and ensure timely completion, given the substantial workload involved.

Important Note:

- Both Part 1 and Part 2 of the SOA will be evaluated separately in Week 6 and Week 10 submission deadline.

- Failure to submit Part 1 by the due date will result in late penalties as per CQU Assessment Policy.

Week 6 Monday (25 Aug 2025) 11:45 pm AEST

Refer to the Task Description and Submission Instructions on Moodle in the

Week 8 Monday (8 Sept 2025)

Feedback via Moodle in the

Details about how your work will be graded and what's expected will be available on Moodle in the <ASSESSMENT> tile.

Remember, Part 1 of the SOA will be graded on the due date in Week 6 and Part 2 of the SOA template will be graded on the due date in Week 10.

Therefore, you cannot make amendments to Part 1 after submission in Week 6. Therefore, get this first part right so the financial plan flows correctly.

- Research and identify client data in developing a statement of advice

- Apply professional and ethical principles pertaining to the financial planning process

- Employ communication skills to manage client relationships

- Communication

- Problem Solving

- Information Literacy

- Team Work

- Information Technology Competence

- Cross Cultural Competence

- Ethical practice

2 Practical Assessment

Assignment Instructions: Continuing Statement of Advice (SOA) - Part 2

Overview:

This assignment builds upon Part 1 of the SOA group project.

You are required to maintain the same group members from Part 1, which you submitted in Week 6, for continuity.

Teaching and Assessment Learning Approach

The teaching approach of this unit continues to be experiential simulated work-integrated learning using case studies.

Instructions:

Comprehensive guidelines, submission procedures, resources, and grading criteria are accessible on Moodle under the <ASSESSMENT> tile.

In summary, your task is to continue and complete Part 2 of the Statement of Advice, following on from Part 1. You cannot make amendments to Part 1. Just work on completing Part 2 of the SOA.

Deadline:

You have until Week 10 to submit your completed SOA assessment.

Submission Instructions:

You MUST upload and submit your entire SOA comprising Parts 1 and 2 to Moodle by the specified due dates.

Grading:

Both Part 1 and Part 2 of the SOA will be evaluated separately as stated above using provided rubrics.

Week 10 Monday (22 Sept 2025) 11:45 pm AEST

Refer to Submission Instructions on Moodle in the

Week 12 Monday (6 Oct 2025)

Feedback via Moodle

Details of the marking criteria (rubrics) and expectations will be provided on Moodle in the Instructions file in the <ASSESSMENT> tile.

Note: Both Part 1 and Part 2 of the SOA will be graded separately in Weeks 6 and Weeks 10 using the rubric provided.

- Research and identify client data in developing a statement of advice

- Employ communication skills to manage client relationships

- Apply financial planning software to model client scenarios.

- Communication

- Problem Solving

- Critical Thinking

- Information Literacy

- Information Technology Competence

- Cross Cultural Competence

- Ethical practice

3 Practical Assessment

Assignment Instructions: Individual Presentation of Statement of Advice (SoA)

Overview:

This assignment is an INDIVIDUAL task.

Detailed guidelines, submission procedures, resources, and marking criteria will be available on Moodle under the <ASSESSMENT> tile.

Teaching and Assessment Learning Approach

The teaching approach of this assessment continues to be experiential simulated work-integrated learning using case studies.

Instructions:

In summary, you are tasked with setting up a typical adviser-client environment and presenting your Statement of Advice (SoA) to a mock client.

Through this presentation, you will demonstrate your proficiency in:

- Applying compliance procedures and communication skills in delivering comprehensive financial planning advice.

- Establishing client relationships and fulfilling ethical and professional responsibilities.

Important Notes:

Recording Requirement:

Your presentation must be recorded.

While real-life presentations can last up to 2 hours, for this assignment, your presentation should be limited to 30 minutes.

Marking will be limited to the first 30 minutes for any recordings longer than 30 minutes.

Recording logistics will be confirmed during Orientation discussions in Zoom Workshops and detailed in the <ASSESSMENT> Section on Moodle and live or recorded Zoom Workshops.

Week 12 Friday (10 Oct 2025) 11:45 pm AEST

Presentations need to be finalised and submitted by the due date. Refer to Submission Instructions on Moodle in the

Exam Week Friday (24 Oct 2025)

Grading via Moodle within two weeks of submission.

Details of the marking criteria (rubrics) and expectations will be provided on Moodle in the <ASSESSMENT> tile on Moodle.

- Apply professional and ethical principles pertaining to the financial planning process

- Communication

- Problem Solving

- Critical Thinking

- Information Literacy

- Cross Cultural Competence

- Ethical practice

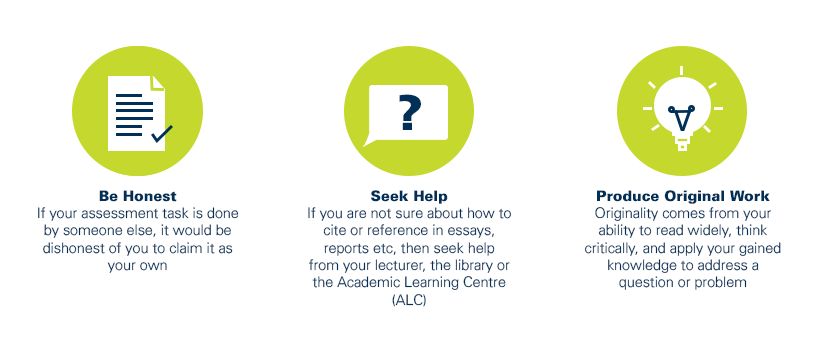

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?