Overview

This unit covers investment analysis of complex investment portfolios. You will be introduced to contemporary investment theories and construct a client focused portfolio. You will examine the risks associated with domestic and international investment products.

Details

Pre-requisites or Co-requisites

Prerequisite: FINC 19011

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 1 - 2025

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Undergraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from Student evaluation

An extra amount of time for the exam overall should be allocated given the expectation of referencing. Student requested an extra 15-30 minutes (at least).

Drop the number of exam questions from 10 to 8 questions, to give students more time for in-text referencing.

Feedback from Student evaluation

Students found the Financial Planning Assessment more difficult than expected. Even though there was plenty of added help in the template it was still difficult and was harder than what the student expected in regard to the content covered.

Conduct additional workshops or tutorials focused on financial planning assessment topics. Use these sessions to clarify difficult concepts and offer hands-on practice.

Feedback from Self-reflection

Students are dissatisfied with the Unit coordinator developed content that comes from several different resources and references.

Returning to textbooks will give them more content structure, and detail in one resource, rather than expecting them to access several different resources or sources of knowledge and information to learn from.

- Explain the principles of advanced investment analysis and risk management

- Construct client focused portfolios using domestic and international financial products

- Solve real world complex investment problems.

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | ||

|---|---|---|---|

| 1 | 2 | 3 | |

| 1 - Written Assessment - 50% | |||

| 2 - Take Home Exam - 50% | |||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | ||

|---|---|---|---|

| 1 | 2 | 3 | |

| 1 - Communication | |||

| 2 - Problem Solving | |||

| 3 - Critical Thinking | |||

| 4 - Information Literacy | |||

| 5 - Team Work | |||

| 6 - Information Technology Competence | |||

| 7 - Cross Cultural Competence | |||

| 8 - Ethical practice | |||

| 9 - Social Innovation | |||

| 10 - First Nations Knowledges | |||

| 11 - Aboriginal and Torres Strait Islander Cultures | |||

Alignment of Assessment Tasks to Graduate Attributes

| Assessment Tasks | Graduate Attributes | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

| 1 - Written Assessment - 50% | |||||||||||

| 2 - Take Home Exam - 50% | |||||||||||

Textbooks

Fundamentals of Investing: Global Edition

Edition: 14 (2023)

Authors: Scott B. Smart and Chad J. Zutter

Pearson

Harlow Harlow , Essex , United Kingdom

ISBN: 9781292443256 9781292317083

To make a purchase inquiry either go here or your own source:

- Fundamentals of Investing, Global edition, 14th edition eBook Pearson

- Fundamentals of investing, Global edition, 14th edition Pearson

- CQUniversity Bookshop

To make a purchase inquiry either go here or your own source:

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

- Financial Planning Software

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

a.mcinnes@cqu.edu.au

Module/Topic

The Investment Environment:

- Nature of investments

- Investment process

- Major asset classes

- Role and function of financial markets

- Types of investors and investor life cycle

- Attributes that distinguish one investment from another

- Major Financial Markets

Chapter

Refer to Study Guide for:

- Week 1 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 1

- For the work integrated learning (WIL) practical statement of Advice (SOA) assessment download the three files from Moodle.

- Read the SOA assessment instructions and start unpacking the case study

- Follow the grading guidelines in the SOA assessment rubrics carefully

- Use the Q&A Forum on Moodle if you are unsure how to proceed

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Securities Markets and Transactions:

- Basic types of securities markets

- Initial public offering (IPO) process

- How securities transactions take place in the secondary markets

- Role that market makers play

- Regulation of securities markets

Chapter

Refer to Study Guide for:

- Week 2 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 2

- For the WIL practical assessment this week complete the ‘Scope of our advice’; ‘Your goals and objectives’ and ‘Your risk tolerance’ sections of the SOA

- Follow the grading guidelines in the SOA assessment rubrics carefully

- Engage on Moodle Q&A to address any concerns or queries

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Investment Information and Securities Transactions:

- Roles of investment advisers

- Basic types of orders, online transactions, transaction costs, and the legal aspects of investor protection

- Role of stockbrokers, including the services they provide, selection of a stockbroker, opening an account, and transaction basics

- Share and bond market averages and indexes

- Major types and sources of investment information

Chapter

Refer to Study Guide for:

- Week 3 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 3

- For the WIL practical assessment complete the ‘Our Recommended Investment Strategies’ section of the SOA

- Follow the grading guidelines in the SOA assessment rubrics carefully

- Engage on Moodle Q&A to address any concerns or queries

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Return and Risk:

- Return, its components, the forces that affect the level of return, and historical returns

- Risk of a single asset, risk assessment, and the steps that combine return and risk

- Sources of risk that might affect potential investments

- Role of time value of money in measuring return

- Analysing investments

Chapter

Refer to Study Guide for:

- Week 4 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 4

- For the WIL practical assessment complete the ‘Our Investment Product Recommendations’ section using the prompts/analysis questions within the SOA

- Follow the grading guidelines in the SOA assessment rubrics carefully

- Engage on Moodle Q&A to address any concerns or queries

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Modern Portfolio Theory

- Portfolio objectives, portfolio returns and standard deviation

- Portfolio betas, the risk-return tradeoff, and approaches to portfolio management

- Modern portfolio management.

- Capital asset pricing model (CAPM) conceptually, mathematically, and graphically

- Beta to measure risk

- Correlation

- Diversification

Chapter

Refer to Study Guide for:

- Week 5 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 5

- For the practical assessment complete the “Replacement and alternative product recommendations” sections of the SOA

- Follow the grading guidelines in the SOA assessment rubrics carefully

- Engage on Moodle Q&A to address any concerns or queries

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Vacation and Catchup Week

Chapter

Refer to Study Guides Weeks 1 to 5

Events and Submissions/Topic

- Engage on Moodle Q&A to address any concerns or queries

- Catchup if behind with your Statement of Advice Assessment and content

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Common Stocks, Analyzing Common Stocks and Stock Valuation:

- Ordinary share investments

- Share valuations

- Financial measures to assess a company’s performance

- Fundamental analysis and why it is used

- Industry analysis and how investors use it

- Technical analysis

- Performance of shares

Chapter

Refer to Study Guide for:

- Week 6 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 6

- For the WIL practical assessment continue working through the SOA.

- You should be at the stage of completing the ‘Recommended asset allocation’ as well as making a start on the ‘Financial outcomes of our recommended strategies’

- Follow the grading guidelines in the SOA assessment rubrics carefully

- Engage on Moodle Q&A to address any concerns or queries

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Market Efficiency and Behavioral Finance, Preferred Stock and Taxation of Investments

- Efficient market hypothesis

- Behavioral finance and investors’ cognitive biases

- Preference shares, including sources of value and exposure to risk

- Share investment strategies

Chapter

Refer to Study Guide for:

- Week 7 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 7

- For the WIL practical assessment complete the ‘Cost of our advice’ section of the SOA and the ‘Supporting information and Annexures’

- Follow the grading guidelines in the SOA assessment rubrics carefully

- Engage on Moodle Q&A to address any concerns or queries

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Fixed Income Securities, Bond Valuation and Preferred Stocks

- Fixed interest securities as investments

- Investment attributes and uses of bonds

- Bond investment strategies

- Bond performance

- Bond valuations

- How investors value bonds in the marketplace

- Structure of interest rates, including market interest rates

- Yield curves

Chapter

Refer to Study Guide for:

- Week 8 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 8

- For the WIL practical assessment complete the ‘Authority to Proceed with our Advice’, 'How to implement our Advice', final parts of the ‘Supporting information and Annexures’, and References of the SOA template

- Follow the grading guidelines in the SOA assessment rubrics carefully

- Engage on Moodle Q&A to address any concerns or queries

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Mutual (Managed funds) and Exchange Traded Funds:

- Features of managed funds and exchange traded funds

- Sources and calculation of managed fund and ETF returns

- Investor services offered by managed funds

- Types of funds available and the variety of investment objectives these funds seek to fulfil

- Management Investment Services

- Administration Services

- Types of fund loads, fees, and charges

Chapter

Refer to Study Guide for:

- Week 9 Prescribed and Supplementary Reading

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 9

- Finalize your WIL SOA assessment

- Engage on Moodle Q&A to address any concerns or queries

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Managing an investment portfolio:

- How to use an asset allocation scheme to construct a portfolio consistent with investor goals

- Role of limit and stop-loss orders

- Role and logic of dollar-cost averaging, constant-dollar plans, constant-ratio plans, and variable-ratio plans

- Sharpe, Treynor, and Jensen measures to compare a portfolio’s return with a risk-adjusted, market-adjusted rate of return and discuss portfolio revision

- Techniques used to measure income, capital gains, and total portfolio return

- Data and indexes needed to measure and compare investment performance

Chapter

Refer to Study Guide for:

- Week 10 Prescribed and Supplementary Reading

- Refer to the Exam Advice

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 10

- Submit your WIL SOA assessment

- Begin preparations for the exams, including referring to the Exam Advice, Previous Exam Papers and any helpful short-answer exam resources on Moodle

- Complete the student evaluation

- Engage on Moodle Q&A to address any concerns or queries

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

[SCALED] STATEMENT OF ADVICE Due: Week 10 Tuesday (20 May 2025) 11:45 pm AEST

Module/Topic

Options: Puts and Calls:

- Role and use of derivative instruments and markets

- Basic nature of options in general

- Puts and calls and briefly how these investments work

- Potential profit or loss associated with writing put or call options

- How writing options can be used as a strategy for enhancing investment returns

- Risk-free hedge and its importance in options pricing

- How put and call options are valued and the forces that drive option prices in the marketplace

- How these securities can be used by investors

Chapter

Refer to Study Guide for:

- Week 11 Prescribed and Supplementary Reading

- Refer to the Exam Advice

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 11

- Prepare for the exams, including referring to the Exam Advice, Previous Exam Papers and any helpful short-answer exam resources on Moodle

- Complete the student evaluation if you have not already done so

- Engage on Moodle Q&A to address any concerns or queries

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

Futures and Securities

- Essential features of a forward and futures contract

- How the forward and futures market operates

- Role that hedgers and speculators play in the futures market

- How profits are made and lost

- Commodities segment of the futures market

- How investment returns are measured

- Difference between a physical commodity and a financial future

- How these securities can be used in conjunction with other investments

- Difference between forward and future contracts

- Features and advantages of forward and future contracts

- Types of forward and futures contracts listed in Australia

Chapter

Refer to Study Guide for:

- Week 12 Prescribed and Supplementary Reading

- Refer to the Exam Advice

Events and Submissions/Topic

- Refer to the weekly study guide

- Complete self-study questions

- Work through the weekly workbook

- Zoom Workshop recording link available in Week 12

- Prepare for the exams, including referring to the Exam Advice, Previous Exam Papers and any helpful short-answer exam resources on Moodle

- Engage on Moodle Q&A to address any concerns or queries

- Complete the student evaluation survey if you have not already done so

Note: Zoom Workshop access link available in the <Classes and Recordings> tile

- Attend or watch the weekly Zoom Workshop recordings

Module/Topic

- Complete the Student Evaluations

- Refer to the Exam timetable

- Refer to the Exam Advice

Chapter

Review the Exam Advice

Write the Exams on the scheduled date

Events and Submissions/Topic

- Prepare for the exam, including referring to the Exam Advice, Previous Exam Papers and Workshop recordings

- If you have not already done so, complete the Student Evaluation Surveys

ONLINE EXAMINATION Due: Review/Exam Week Tuesday (10 June 2025) 9:00 am AEST

Module/Topic

Refer to the Exam Timetable

End of Term Reports

Chapter

Write the Exams on the scheduled date

Reports finalized by the various relevant committees of CQU SBL

Events and Submissions/Topic

End of term reports available on the Moodle after Certification of Grades

Please email your expression of interest to a.mcinnes@cqu.edu.au to obtain your login details for the financial planning software by census date.

1 Written Assessment

This is an individual assessment.

The teaching approach of this unit is Experiential Learning Theory, developed by David Kolb, where students learn through experience, reflection, conceptualization, and experimentation.

This theory emphasizes learning through experience, reflecting on those experiences, so the student can apply a simulation of the real world and what is learned to their future role as financial adviser.

Using a client case study the student is expected to complete a partially completed financial plan focused on non-superannuation investment strategies and product recommendations for a couple.

This assessment allows the student to engage with a real-world detailed case study, and help the client achieve their investment goals using different investment strategies and new real-world investment products. Not only do the student learn new knowledge but learn to apply the newly acquired knowledge to the case study.

Combining the case study with a work-integrated approach gives students hands-on experience of what it is like to work in a professional practical setting, dealing with a simulated real-world task of completing a financial plan through experimenting with strategies and solutions based on their learning.

Important detailed information for your assessment is on the Moodle site in the <Assessment> tile

Before you begin this assessment, please read the:

- Instructions for completing and submitting your assessment

- Case study background

Task requirements:

- Identify the investment client's objectives, needs and financial situation by reviewing the case study background, fact find and risk profile information provided

- If you choose to use financial planning software, please contact your unit coordinator by email with an expression of interest so that you can receive your unique login User ID and Password

- Prepare a written Investment Statement of Advice using the template provided and financial planning software [Midwinter, Microsoft-Excel and/or related software]

- Using the analysis questions provided within the Statement of Advice template, develop and document appropriate investment strategies and recommendations to achieve the client's investment goals

We provide:

- Instructions document to complete the assessment with a comprehensive grading rubric

- Completed fact find and risk profile document assumedly obtained during a meeting with the client that has already taken place

- A partially completed Statement of Advice template, which you complete to be graded

- Data analysis questions within the Statement of Advice to assist preparing the Statement of Advice document

In summary:

- This is a practical assessment dealing with a real-world financial planning client investment need that uses an experiential learning approach developed by

- Start this assessment as soon as possible, because for some of you it will require learning numerous new skills

- Your unit coordinator and classmates are available via Moodle Q&A forum, as well as pre-arranged Zoom sessions

- Refer to Moodle <Assessment> tile and download all three files relating to this Assessment requirements. Please read these documents carefully

Email your unit coordinator directly to address any personal matters, concerns or difficulties during the term is encouraged

This assignment has the reputation for being challenging, yet useful in terms of how it builds wealth creation knowledge as well as provides employable skills

Engaging with your peers via the Moodle <Q&A Forum> helps manage your study workload of this non-traditional approach to learning.

Week 10 Tuesday (20 May 2025) 11:45 pm AEST

Submission via Moodle

Week 12 Tuesday (3 June 2025)

Grades and Feedback via Moodle

You will be graded for completing the following sections of the Advice document:

- Introduction (Table of Contents)

- Summary of our Advice in a Strategy Map

- Our Recommended Investment Strategies

- Our Investment Product Recommendations

- Replacement and alternative product recommendations included

- Recommended asset allocation

- Financial outcomes of our recommended strategies

- Cost of our advice

- Supporting information and Annexures

- Organization/Structure/Presentation/Mechanics

- Sources/Evidence

Refer to the grading rubrics when completing your assessment so that you meet all the grading criteria.

- Explain the principles of advanced investment analysis and risk management

- Construct client focused portfolios using domestic and international financial products

- Solve real world complex investment problems.

- Communication

- Problem Solving

- Critical Thinking

- Information Literacy

- Team Work

- Information Technology Competence

- Cross Cultural Competence

- Ethical practice

2 Take Home Exam

This is an individual assessment.

Collaboration with other students will result in initiating the academic integrity policy and procedures for all students involved.

This is an open book online timed exam of 3 hours, including downloading, uploading and submission time.

- There is a minimum exam grade of 50% to pass the unit

- You will be typing your answers in the examination template document provided

- You have 5 minutes at the start of the exam to download the exam file via Moodle

- You have 2 hours and 50 minutes to complete the exam in Microsoft-Word

- You have 5 minutes to upload and submit the completed examination paper at the end of 2 hours and 50 minutes

- Late submissions will result in late submission penalties as per the University's Assessment policy

If you encounter problems submitting your paper to Moodle, email it to your unit coordinator by the due date and time

Review/Exam Week Tuesday (10 June 2025) 9:00 am AEST

This date can be changed by the University's exam timetabling scheduling team. Download, complete and submit the online open book exam via Moodle

Exam Week Friday (20 June 2025)

Feedback will be provided via Moodle in the

Open book online exam grading as per the Online Take Home Exam Advice to meet the learning outcomes.

There are eight 5-mark, and one 10-mark case study short answer applied theory questions.

Refer to the Exam Advice for the instructions.

- Explain the principles of advanced investment analysis and risk management

- Solve real world complex investment problems.

- Communication

- Problem Solving

- Critical Thinking

- Information Literacy

- Information Technology Competence

- Cross Cultural Competence

- Ethical practice

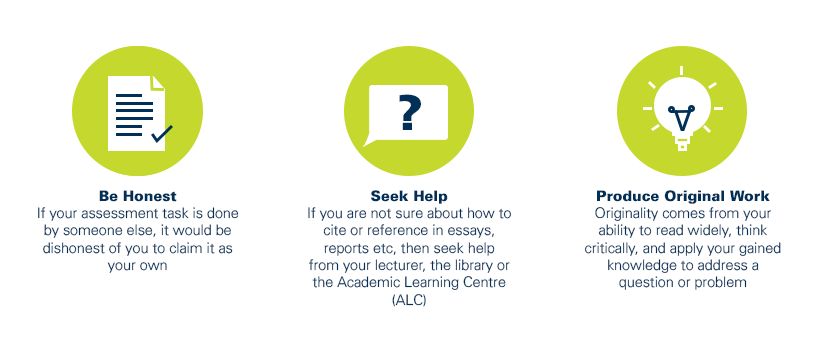

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?