Overview

Airline Finance Analysis is designed to provide you with an understanding of the financial decision-making required in the commercial air transport industry. You will learn about key financial management concepts and how they are applied to the management of airlines. Topics include making investment decisions, financing choices (including leasing), fleet planning, route economics, hedging financial risks, and airline financial statements.

Details

Pre-requisites or Co-requisites

Pre-requisites: AVAT11013 Introduction to Aviation or AVAT11002 Basic Aeronautical Knowledge and AVAT11008 Introduction to Aviation Management and ACCT11059 Accounting, Learning, and Online Communication.

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 2 - 2025

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Undergraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from UC Reflections

Seeking mid-term student feedback

The mid-term in-class student survey should continue to facilitate timely improvements to the student learning experience.

- Interpret airline financial statements to measure the financial performance of an airline

- Discuss financing models for aircraft acquisition that suits the airline financial standing

- Conduct an airline financial risk analysis to propose suitable risk management strategies

- Explain the strategies and processes used by airlines for accessing capital and for capital budgeting

- Evaluate the future trends of industry directions through industry and data analysis from key forecast organisations and external shock factors that threaten the industry’s profitability.

N/A

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| 1 - Online Quiz(zes) - 30% | |||||

| 2 - Case Study - 30% | |||||

| 3 - Group Discussion - 40% | |||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| 1 - Communication | |||||

| 2 - Problem Solving | |||||

| 3 - Critical Thinking | |||||

| 4 - Information Literacy | |||||

| 5 - Team Work | |||||

| 6 - Information Technology Competence | |||||

| 7 - Cross Cultural Competence | |||||

| 8 - Ethical practice | |||||

| 9 - Social Innovation | |||||

| 10 - First Nations Knowledges | |||||

| 11 - Aboriginal and Torres Strait Islander Cultures | |||||

Textbooks

There are no required textbooks.

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

- Computer - ability to access study materials, including instructional videos and scan and upload assessment.

- Computer - ability to access study materials, access Zoom application for meetings and view instructional videos.

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

r.oliveira@cqu.edu.au

Module/Topic

Industry Background & the Language of Business

Chapter

Events and Submissions/Topic

Module/Topic

Financial Statements

Chapter

Events and Submissions/Topic

Module/Topic

Financial Ratios

Chapter

Events and Submissions/Topic

Module/Topic

The Time Value of Money & Net Present Value (NPV)

Chapter

Events and Submissions/Topic

Module/Topic

Risk & Return

Chapter

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Capital Structure & Sources of Capital

Chapter

Events and Submissions/Topic

Module/Topic

Capital Budgeting Methods: Part 1

Chapter

Events and Submissions/Topic

Module/Topic

Capital Budgeting Methods: Part 2

Chapter

Events and Submissions/Topic

Module/Topic

Cost of Capital / Guidance for the Case Study

Chapter

Events and Submissions/Topic

Module/Topic

Management of Current Assets

Chapter

Events and Submissions/Topic

Event: Case Study (30%)

Case Study Due: Week 10 Friday (26 Sept 2025) 5:00 pm AEST

Module/Topic

Aircraft Leasing Analysis / Guidance for the Group Discussion

Chapter

Events and Submissions/Topic

Module/Topic

Airline Hedging Practices / Guidance for the Online Exam

Chapter

Events and Submissions/Topic

Event: Group Discussion (40%)

Module/Topic

N/A

Chapter

Events and Submissions/Topic

Event: Online Exam (30%)

Group Discussion Due: Review/Exam Week Tuesday (14 Oct 2025) 12:00 pm AEST

Module/Topic

Chapter

Events and Submissions/Topic

1 Online Quiz(zes)

Online quizzes will be conducted in Week 6 covering all the theory content of Weeks 1-5, and in Week 11 covering al the theory of Weeks 6-10.

AI ASSESSMENT SCALE: NO AI

You must not use Al at any point during the assessment. You must demonstrate your core skills and knowledge.

This assessment is exempted from the 72-hour submission grace period and must be completed by the stated submission date/time.

Other

Due dates for each quiz are detailed on Moodle and will be reaffirmed in the Lectures

As specified after the closing date for each quiz.

This is a graded assessment. You must obtain an overall mark of at least 50% in each online quiz to pass the assessment item.

- Interpret airline financial statements to measure the financial performance of an airline

- Discuss financing models for aircraft acquisition that suits the airline financial standing

2 Case Study

Students must select a current airline, analyse, and discuss its recent history and performance, from both a financial and an operational perspective (past 3 years).

AI ASSESSMENT SCALE: AI PLANNING

You may choose to employ Al for planning your essay, for the development of ideas, and/or research. Your final submission should reflect how you have developed and refined these ideas.

Week 10 Friday (26 Sept 2025) 5:00 pm AEST

This is a graded assessment. You must obtain an overall mark of at least 50% in the case study to pass this assessment item.

- Interpret airline financial statements to measure the financial performance of an airline

- Discuss financing models for aircraft acquisition that suits the airline financial standing

- Conduct an airline financial risk analysis to propose suitable risk management strategies

- Explain the strategies and processes used by airlines for accessing capital and for capital budgeting

- Evaluate the future trends of industry directions through industry and data analysis from key forecast organisations and external shock factors that threaten the industry’s profitability.

3 Group Discussion

Students must discuss the results of their case studies, comparing the financial performances of airlines in their group, providing 4 to 6 recommendations for increasing, maintaining and/or achieving future profitability. This assignment is to be presented in Week 13 (Review Week).

AI ASSESSMENT SCALE: NO AI

You must not use Al at any point during the assessment. You must demonstrate your core skills and knowledge.

This assessment is exempted from the 72-hour submission grace period and must be completed by the stated submission date/time.

Review/Exam Week Tuesday (14 Oct 2025) 12:00 pm AEST

This is a graded assessment. You must obtain an overall mark of at least 50% in the presentation to pass this assessment item.

- Conduct an airline financial risk analysis to propose suitable risk management strategies

- Explain the strategies and processes used by airlines for accessing capital and for capital budgeting

- Evaluate the future trends of industry directions through industry and data analysis from key forecast organisations and external shock factors that threaten the industry’s profitability.

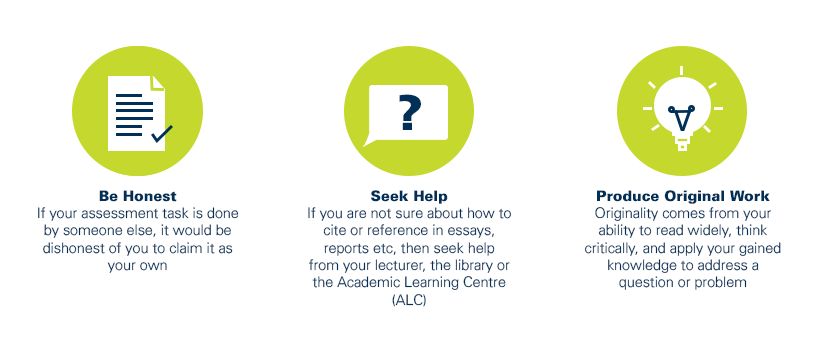

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?