Overview

Fraud is a major problem, estimated to cost Australia over $3 billion each year. The incidence of fraud and corporate failure is increasing along with its cost. This unit is designed to provide you with an understanding of the risks of fraud or corporate failure occurring and an appreciation for the subsequent forensic review and processes. You will learn appropriate preventive and detective methods, examine the wide range of fraud threats to individuals and organisations, and appreciate the relevant legal resolution processes.

Details

Pre-requisites or Co-requisites

Pre-requisiteACCT20072 Accounting Systems & Information Assurance

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 1 - 2024

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Postgraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from Unit Evaluation

Provided clear unit requirements. Provided useful learning materials. Provided useful feedback.

None

- Distinguish the source of potential fraud threats to organisations

- Apply Fraud Triangle Theory to identify potential fraudsters

- Distinguish known fraud methods and identify internal controls that reduce opportunities for fraud

- Recognise and understand accounting symptoms of fraud, and follow investigation processes

- Distinguish the criminal and civil legal processes for resolving alleged fraud.

N/A

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| 1 - Online Quiz(zes) - 10% | |||||

| 2 - Practical Assessment - 30% | |||||

| 3 - Take Home Exam - 60% | |||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| 1 - Knowledge | |||||

| 2 - Communication | |||||

| 3 - Cognitive, technical and creative skills | |||||

| 4 - Research | |||||

| 5 - Self-management | |||||

| 6 - Ethical and Professional Responsibility | |||||

| 7 - Leadership | |||||

| 8 - Aboriginal and Torres Strait Islander Cultures | |||||

Alignment of Assessment Tasks to Graduate Attributes

| Assessment Tasks | Graduate Attributes | |||||||

|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| 1 - Online Quiz(zes) - 10% | ||||||||

| 2 - Practical Assessment - 30% | ||||||||

| 3 - Take Home Exam - 60% | ||||||||

Textbooks

Fraud Examination

Edition: 6th edn (2018)

Authors: Albrecht et al

Cengage Learning

United States

ISBN: 9781337619677

Binding: eBook

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

k.islam@cqu.edu.au

Module/Topic

Fraud – Nature, Perpetrators & Motivation

Fraud in Australia

Chapter

ALB ch 1-2

Events and Submissions/Topic

Module/Topic

Fraud Methods – Manual and IT Environments

Chapter

ALB ch 14, 17

Events and Submissions/Topic

Quiz 1 Opens 17 March 9.00 AM AEST

Module/Topic

Fraud Prevention

Chapter

ALB ch 3-4

Events and Submissions/Topic

Quiz 1 Closes 24 March 5:00 PM AEST

Module/Topic

Fraud Detection

Data Driven Detection

Chapter

ALB ch 5-6

Events and Submissions/Topic

Quiz 2 Opens 31 March 9:00 AM AEST

Module/Topic

Fraud Investigation

Inquiry Methods

Chapter

ALB ch 7-10

Events and Submissions/Topic

Quiz 2 Closes 7 April 5:00 PM AEST

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Management Fraud

Detection methods, including ratio analysis

Chapter

ALB ch 11-13

Events and Submissions/Topic

Quiz 3 Opens 21 April 9:00 AM AEST

Module/Topic

Identity Fraud

Chapter

ALB ch 15

Events and Submissions/Topic

Quiz 3 Closes 28 April 5:00 PM AEST

Module/Topic

Other Types of Fraud e.g. Taxation, Elderly, Insurance

Chapter

ALB ch 16

Events and Submissions/Topic

Quiz 4 Opens 05 May 9:00 AM AEST

Module/Topic

Not-for-Profit Sector

Chapter

Readings

Events and Submissions/Topic

Quiz 4 Closes 12 May 5:00 PM AEST.

Practical Assessment Part B: Take-Home Test (worth 20% of marks for the unit) will be held Friday 9.00 AM AEST in Week 9.

Module/Topic

Medicare Fraud

Corporate Failure

Chapter

Readings

Events and Submissions/Topic

Quiz 5 Opens 19 May 9:00 AM AEST

Module/Topic

Fraud Resolution

Expert Witness

Chapter

ALB ch 18

Events and Submissions/Topic

Quiz 5 Closes 26 May 5:00 PM AEST

Practical Assessment Part A: Report (worth 10% of marks for the unit) due Friday 5.00 PM AEST in Week 11.

Module/Topic

Unit Review

Chapter

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

1 Online Quiz(zes)

Five (5) fortnightly online quizzes are required to be completed. Each quiz is to be completed individually, is open for approximately 7 days, and covers the preceding 2 weeks of classes. Each quiz consists of a set of multiple-choice questions and is marked out of 15. The weighting for quiz results is 10% of the total marks.

5

Fortnightly

Fortnightly quizzes will open on Sunday at 9:00 AM AEST and will close on the following Sunday at 5:00 PM AEST. Opening and closing dates of the 5 quizzes are available in weekly schedule.

Your results of the quiz will be automatically generated and will be displayed upon completion of the quiz. You can access your results again on the unit website via the Grade book. You will be able to check your quiz for incorrect answers after the quiz has closed.

This assessment item will assess your problem-solving skills in relation to the forensic accounting concepts covered in the prior 2 weeks.

- Distinguish the source of potential fraud threats to organisations

- Apply Fraud Triangle Theory to identify potential fraudsters

- Distinguish known fraud methods and identify internal controls that reduce opportunities for fraud

- Knowledge

- Cognitive, technical and creative skills

- Ethical and Professional Responsibility

2 Practical Assessment

This assessment has 2 parts - Part A Report (10%) and Part B Take-Home Test (20%).

Part A Report (10%): This assignment requires submission of a written report on a chosen topic. Word length for the report – 1500 words. You should refer to at least 5 sources in preparing your report using APA referencing. Topics and rubric will be available on Moodle. Submit your report via Moodle by the due date in Week 11.

Part B Take-Home Test (20%): This is a 1-hour test to be held at a scheduled time on Friday in Week 9. Two case studies and/ or short-answer questions will be based on material covered in Weeks 1-5. Students may refer to lecture notes and the eBook, but not other Internet resources.

Part A Report: Report is due in Week 11 on Friday 5:00 PM AEST. Part B Take-Home Test: To be conducted in Week 9 on Friday 9.00 AM AEST.

Part A Report: Within 14 days of the due date. Part B Take-Home Test: Within 14 days of the due date.

Part A: Report: Use of sources, correct referencing, structure of report, synthesis and conclusions, quality of writing, grammar, syntax and spelling. Please refer to marking rubric on Moodle.

Part B: Take-Home Test: The test will examine students' ability in identifying relevant theory and demonstrating knowledge, applying relevant theory and knowledge to solve problems, and quality of writing, grammar, syntax and spelling.

- Apply Fraud Triangle Theory to identify potential fraudsters

- Distinguish known fraud methods and identify internal controls that reduce opportunities for fraud

- Recognise and understand accounting symptoms of fraud, and follow investigation processes

- Distinguish the criminal and civil legal processes for resolving alleged fraud.

- Knowledge

- Communication

- Cognitive, technical and creative skills

- Research

- Self-management

- Ethical and Professional Responsibility

3 Take Home Exam

The take-home exam will be posted to Moodle at the date and time scheduled for the exam. This document is to be downloaded, completed and submitted by the due time. The duration of the exam will be announced in moodle, allowing for downloading, completion and submission. Late submissions will not be marked. Further information is available on Moodle.

During the examination period.

Results will be released after approval of grades.

The paper will examine students' ability in identifying relevant theory and demonstrating knowledge, applying relevant theory and knowledge to solve problems, and quality of writing, grammar, syntax and spelling.

- Distinguish the source of potential fraud threats to organisations

- Apply Fraud Triangle Theory to identify potential fraudsters

- Distinguish known fraud methods and identify internal controls that reduce opportunities for fraud

- Recognise and understand accounting symptoms of fraud, and follow investigation processes

- Distinguish the criminal and civil legal processes for resolving alleged fraud.

- Knowledge

- Cognitive, technical and creative skills

- Ethical and Professional Responsibility

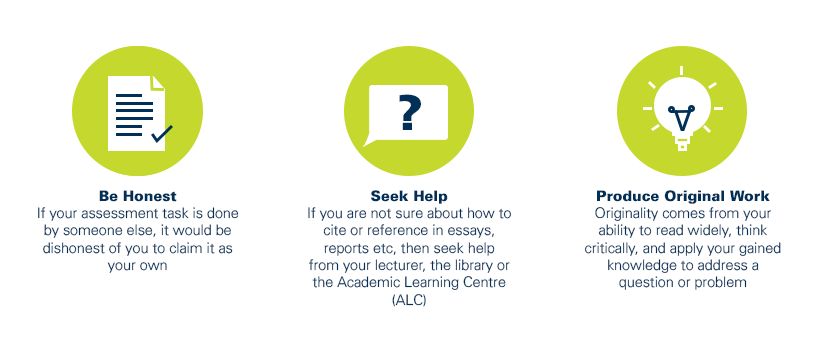

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?