Overview

This unit engages students to establish an advanced understanding of the nature and development of accounting theory and its application and regulation. It builds on the students' technical skills and their foundational knowledge of accounting practice. The topics covered include the history and development of accounting, traditional approaches to the formulation of accounting, standard setting and institutional arrangements, harmonisation of accounting standards, a range of theoretical perspectives and the links between accounting theory, research and practice.

Details

Pre-requisites or Co-requisites

Students must successfully complete ACCT20071 Foundations of Financial Accounting prior to enrolling in this unit. Students who have successfully completed ACCT29083 Theory of Accounting cannot enrol in this unit.

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 1 - 2024

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Postgraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from SUTE evaluation.

Feedback on assessment items

Provide more relevant feedback on assessment items.

- Critically evaluate the Australian accounting and reporting regulatory environment, comparing it to regulatory environments in other countries as well as their progress in the international harmonisation project

- Analyse complex and current business issues through the lens of appropriately selected and applied theories

- Select and use effective project and research skills to evaluate individually and synthesise accounting knowledge, and communicate findings in an appropriately professional format

- Demonstrate critical thinking applying the knowledge of accounting theories

- Reflecting on Feedback from Others to improve Performance.

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| 1 - Online Test - 10% | |||||

| 2 - Written Assessment - 40% | |||||

| 3 - Take Home Exam - 50% | |||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| 1 - Knowledge | |||||

| 2 - Communication | |||||

| 3 - Cognitive, technical and creative skills | |||||

| 4 - Research | |||||

| 5 - Self-management | |||||

| 6 - Ethical and Professional Responsibility | |||||

| 7 - Leadership | |||||

| 8 - Aboriginal and Torres Strait Islander Cultures | |||||

Alignment of Assessment Tasks to Graduate Attributes

| Assessment Tasks | Graduate Attributes | |||||||

|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| 1 - Online Test - 10% | ||||||||

| 2 - Written Assessment - 40% | ||||||||

| 3 - Take Home Exam - 50% | ||||||||

Textbooks

Contemporary Issues in Accounting

Edition: Third (2023)

Authors: Rankin et al.

John Wiley & Sons Australia Ltd

Milton, Brisbane Milton, Brisbane , Queensland , Australia

ISBN: E-Text 9780730397830 / Print 9780730397823

Binding: eBook

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

k.islam@cqu.edu.au

Module/Topic

An introduction to theoretical perspective of accounting

Chapter

1

Events and Submissions/Topic

Module/Topic

The conceptual framework for financial reporting

Chapter

5

Events and Submissions/Topic

Module/Topic

Standard setting for financial reporting

Chapter

2

Events and Submissions/Topic

Module/Topic

Measurement in accounting

Chapter

3

Events and Submissions/Topic

Quiz 1 will appear online in Moodle in Week 4.

Assessment 2 will be available in moodle in Week 4

Module/Topic

Specific theories for understanding and explaining accounting/reporting practice

Chapter

4

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Products of the accounting system

Chapter

13

Events and Submissions/Topic

Module/Topic

The role of corporate governance in corporate accountability and reporting

Chapter

6

Events and Submissions/Topic

Online Quiz 1 is due Week 7 Friday 11.45 PM AEST.

Module/Topic

Capital market research in examining the reactions to accounting information

Chapter

8

Events and Submissions/Topic

Module/Topic

The effects of earnings management on reported earnings and corporate failure

Chapter

9

Events and Submissions/Topic

Quiz 2 will appear online in Moodle in Week 9.

Module/Topic

Fair value accounting

Chapter

12

Events and Submissions/Topic

Module/Topic

Sustainability and corporate social responsibility

Chapter

10

Events and Submissions/Topic

Module/Topic

Unit review

Chapter

Events and Submissions/Topic

Online Quiz 2 is due Week 12 Friday 11.45 PM AEST.

Module/Topic

No teaching in this week

Chapter

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

1 Online Test

This assessment item is an individual task which comprises two online quizzes (quiz 1 and quiz 2) of 5 marks each. Each quiz consists of multiple choice questions randomly generated from a pool of questions. Quiz 1 will appear online in Moodle in Week 4. Quiz 2 will appear online in Moodle in Week 9. Both quizzes will remain open until the due date and time provided for completion of those quizzes.

Each quiz is set on the basis of specific modules as under:

Quiz (Online Test) 1: Modules 1–6

Quiz (Online Test) 2: Modules 7–11.

You will need to see the related chapters that are covered in different modules as stated above. If any student faces technical difficulties with Moodle or network communications while trying to undertake these quizzes should email the unit coordinator immediately, and where appropriate a second attempt may be arranged.

Online Quiz 1 is due Week 7 Friday 11.45 PM AEST. Online Quiz 2 is due Week 12 Friday 11.45 PM AEST.

The results of these online quizzes will be made available as soon as each quiz is submitted.

Each quiz comprises multiple questions for 5 marks. Mark will be provided on the basis of one correct (or most

correct) answer to each question.

- Critically evaluate the Australian accounting and reporting regulatory environment, comparing it to regulatory environments in other countries as well as their progress in the international harmonisation project

- Analyse complex and current business issues through the lens of appropriately selected and applied theories

- Knowledge

2 Written Assessment

This is an individual task. The assignment will require students to undertake research examining how selected theories,accounting standards and frameworks guide the preparation of annual reports of listed companies.Unless otherwise suggested by the unit coordinator, companies will be selected from the Australian Securities Exchange (ASX).

The unit coordinator will advise which company/ies will have to be selected. The assessment will be available in moodle in Week 4

Week 10 Monday (13 May 2024) 11:45 pm AEST

Assignment must be submitted on or before the due date specified via Moodle submission facility.

Week 12 Friday (31 May 2024)

Detailed marking criteria will be provided in the assessment in moodle with due consideration of the following:

Demonstration of knowledge of relevant theories, accounting standards and frameworks

Ability to analyse and explain company annual reporting practices applying relevant theories, accounting standards and frameworks

Correct referencing, appropriate grammar, readability and structure of the report.

- Critically evaluate the Australian accounting and reporting regulatory environment, comparing it to regulatory environments in other countries as well as their progress in the international harmonisation project

- Analyse complex and current business issues through the lens of appropriately selected and applied theories

- Select and use effective project and research skills to evaluate individually and synthesise accounting knowledge, and communicate findings in an appropriately professional format

- Demonstrate critical thinking applying the knowledge of accounting theories

- Reflecting on Feedback from Others to improve Performance.

- Knowledge

- Communication

- Research

3 Take Home Exam

This is an individual task. For this exam, students will have to learn multiple concepts and theories covered in the unit.

Detailed information of take home exam will be provided in moodle in week 10.

Results will not be published before certification date.

Take Home Exam will be assessed against marks for each question. Student's depth of knowledge about various concepts and theories will be taken into consideration while marking.

- Critically evaluate the Australian accounting and reporting regulatory environment, comparing it to regulatory environments in other countries as well as their progress in the international harmonisation project

- Analyse complex and current business issues through the lens of appropriately selected and applied theories

- Demonstrate critical thinking applying the knowledge of accounting theories

- Reflecting on Feedback from Others to improve Performance.

- Knowledge

- Cognitive, technical and creative skills

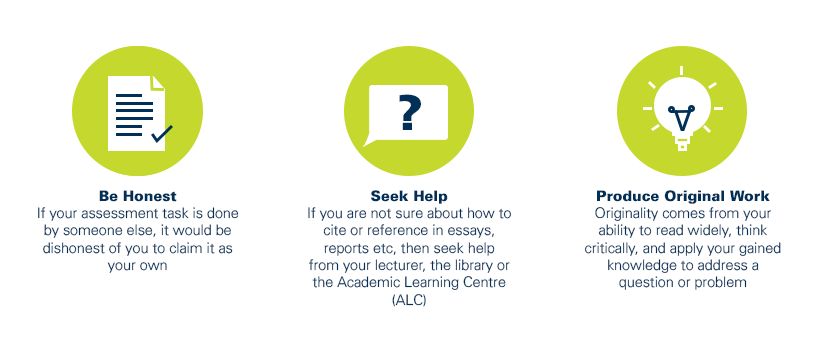

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?