Overview

This unit introduces you to the technical aspects of accounting in Australia. You will gain a sound understanding and knowledge of the core accounting concepts for preparing financial statements. You will also learn the foundation principles and concepts of accounting, especially the accounting equation and accrual accounting and learn how to analyse and interpret financial statements.

Details

Pre-requisites or Co-requisites

There are no requisites for this unit.

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 2 - 2024

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Postgraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from UC's reflections and team discussions

Need to support late enrollments

Provide dedicated zoom sessions for late enrolling students

Feedback from UC's reflections and team discussions

Need for more resources for responsible use of AI

Provide more resources for responsible use of AI

- Define accounting and identify the users of accounting information and prepare the financial statements

- Demonstrate mastery of core accounting concepts, such as accrual accounting, by correctly applying these concepts to contemporary business problems, and reporting on the outcomes

- Work as a team leader and as part of a team to acquire new knowledge, or to identify and solve accounting related problems.

- Correctly analyse and interpret the financial information contained within financial statements through the use of appropriate financial ratios, and provide professionally written reports on the results of those analyses.

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Practical Assessment - 30% | ||||

| 2 - Online Quiz(zes) - 10% | ||||

| 3 - Online Test - 60% | ||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Knowledge | ||||

| 2 - Communication | ||||

| 3 - Cognitive, technical and creative skills | ||||

| 4 - Research | ||||

| 5 - Self-management | ||||

| 6 - Ethical and Professional Responsibility | ||||

| 7 - Leadership | ||||

| 8 - Aboriginal and Torres Strait Islander Cultures | ||||

Textbooks

Financial Accounting

Edition: 9th (2021)

Authors: Nobles, Mattison, Matsumura, Best, Fraser, Tan Willett

Pearson Australia

Melbourne Melbourne , VICTORIA , Australia

ISBN: 9780655700357

If you are having issues accessing the eBook at the Library website, both paper and eBook copies can be purchased at the CQUni Bookshop here: http://bookshop.cqu.edu.au (search on the Unit code)

Binding: eBook

If you are having issues accessing the eBook at the Library website, both paper and eBook copies can be purchased at the CQUni Bookshop here: http://bookshop.cqu.edu.au (search on the Unit code)

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

m.kansal@cqu.edu.au

Module/Topic

The role of Accounting in decision making

Chapter

One

Events and Submissions/Topic

Introduction to unit and assessments

Module/Topic

Recording business transactions

Chapter

Two

Events and Submissions/Topic

Module/Topic

The adjusting process

Chapter

Three

Events and Submissions/Topic

The teaching staff will organise students into groups of 3 for the written assessment and group presentation tasks.

Module/Topic

Completing the accounting cycle

Chapter

Four

Events and Submissions/Topic

Module/Topic

Retailing operations

Chapter

Five

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Retail inventory

Chapter

Six

Events and Submissions/Topic

Module/Topic

Internal control and cash

Chapter

Eight

Events and Submissions/Topic

Module/Topic

Receivables

Chapter

Nine

Events and Submissions/Topic

Module/Topic

Non-current assets: Property, plant and equipment, and intangibles

Chapter

Ten

Events and Submissions/Topic

Module/Topic

Current liabilities and payroll

Chapter

Eleven

Events and Submissions/Topic

Module/Topic

Financial statement analysis and Review of the Term

Chapter

Eighteen

Events and Submissions/Topic

Module/Topic

Unit review/Assessment 3

Chapter

Revision resources on Moodle

Events and Submissions/Topic

Assessment 3, Online test Due Week 12. Details to be published on Moodle.

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

1 Practical Assessment

This assessment comprises two components. The due date for the submission (both excel and presentation) is Monday of week 6. For the Written task (Excel) component, each group of not more than three students submits an assigned question. This assessment contributes 30% towards the final grade. Distance/Flex students may be allowed to complete the written assessment and presentation individually, if they have been for the same.

Week 6 Monday (19 Aug 2024) 5:00 pm AEST

Submit via Moodle

Week 8 Monday (2 Sept 2024)

Results available via Moodle grade book

Students will be assessed on the criteria as per detailed marking rubrics given on Moodle.

Group written task

1. Completion and Accuracy

2. Appropriate use of Formats/Formulas in excel

Group presentation

1. Communication of Theoretical Concept/ Practical Application//Demonstration//Reasoning

2. Completion and Accuracy

- Define accounting and identify the users of accounting information and prepare the financial statements

- Demonstrate mastery of core accounting concepts, such as accrual accounting, by correctly applying these concepts to contemporary business problems, and reporting on the outcomes

- Work as a team leader and as part of a team to acquire new knowledge, or to identify and solve accounting related problems.

- Correctly analyse and interpret the financial information contained within financial statements through the use of appropriate financial ratios, and provide professionally written reports on the results of those analyses.

2 Online Quiz(zes)

This is an individual assignment. This assessment must be completed by all students. The online quiz will contain 20 questions, either/or a combination of multiple choice, true/false. The multiple-choice questions can be based on practical or conceptual aspects.

Week 9 Friday (13 Sept 2024) 5:00 pm AEST

Marks will be available to students on the submission of the Quiz

Completion and Accuracy

- Define accounting and identify the users of accounting information and prepare the financial statements

- Demonstrate mastery of core accounting concepts, such as accrual accounting, by correctly applying these concepts to contemporary business problems, and reporting on the outcomes

3 Online Test

This is an individual assessment due in week 12. Details will be published on Moodle

No Assessment Criteria

No submission method provided.

- Define accounting and identify the users of accounting information and prepare the financial statements

- Demonstrate mastery of core accounting concepts, such as accrual accounting, by correctly applying these concepts to contemporary business problems, and reporting on the outcomes

- Correctly analyse and interpret the financial information contained within financial statements through the use of appropriate financial ratios, and provide professionally written reports on the results of those analyses.

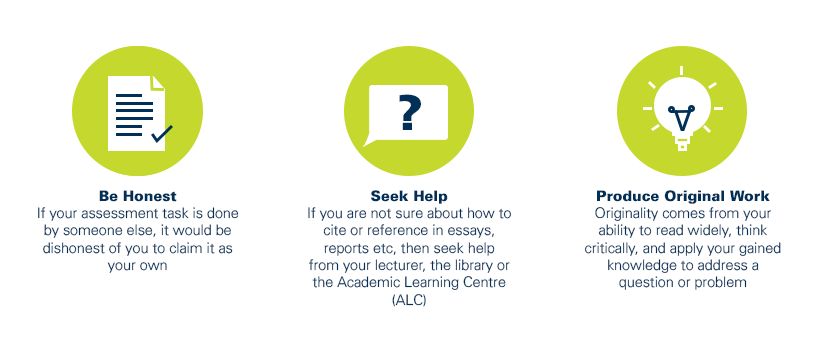

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?