Overview

In this unit, you will examine the professional environment of the auditor, particularly audit standards, audit practice, legal liability, ethics and current developments (e.g., Audit Expectation Gap). Audit methodology and planning, internal control assessments and exposure to influences of information technology on audit testing will also be examined. The unit material, while drawing on audit theory, is very practically based for the needs of future audit professionals. Statistical and non-statistical audit sampling is also covered in detail. With an emphasis on professional and ethical practice, you will gain an appreciation of the role and needs of audit professionals in business environments.

Details

Pre-requisites or Co-requisites

Pre-requisite: ACCT11081 or ACCT19084

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 1 - 2025

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 6-credit Undergraduate unit at CQUniversity requires an overall time commitment of an average of 12.5 hours of study per week, making a total of 150 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a graded unit: your overall grade will be calculated from the marks or grades for each assessment task, based on the relative weightings shown in the table above. You must obtain an overall mark for the unit of at least 50%, or an overall grade of 'pass' in order to pass the unit. If any 'pass/fail' tasks are shown in the table above they must also be completed successfully ('pass' grade). You must also meet any minimum mark requirements specified for a particular assessment task, as detailed in the 'assessment task' section (note that in some instances, the minimum mark for a task may be greater than 50%). Consult the University's Grades and Results Policy for more details of interim results and final grades.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

Feedback, Recommendations and Responses

Every unit is reviewed for enhancement each year. At the most recent review, the following staff and student feedback items were identified and recommendations were made.

Feedback from Student's evaluation

To improve the clarity of Unit expectation (in relation to assessment tasks)

1.Maintain regular communication with students through CQU Success and Moodle announcements to provide timely updates on upcoming assessment tasks and highlight available resources on Moodle that support their learning and assessment preparation. 2. Regularly review and refine information pack and marking rubrics to ensure clarity in performance expectations for each assessment task, thereby enhancing transparency and consistency in grading.

- Exercise judgement under supervision to provide possible solutions to routine audit and accounting problems in straightforward concepts using appropriate regulatory, ethical, economic and governance perspectives

- Integrate theoretical and technical audit and accounting knowledge in an audit context

- Critically apply theoretical and technical audit and accounting knowledge and skills to provide possible solutions to routine audit related issues

- Justify and communicate audit and accounting advice and ideas in straightforward contexts to assist with the decisions of users of financial reports

- Reflect on performance to identify and action learning opportunities and self-improvements.

ACCT19064 supports external accreditation requirements for business acumen, critical thinking and communication competencies.

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| 1 - Practical Assessment - 15% | |||||

| 2 - Report - 40% | |||||

| 3 - Practical and Written Assessment - 45% | |||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | ||||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| 1 - Communication | |||||

| 2 - Problem Solving | |||||

| 3 - Critical Thinking | |||||

| 4 - Information Literacy | |||||

| 5 - Team Work | |||||

| 6 - Information Technology Competence | |||||

| 7 - Cross Cultural Competence | |||||

| 8 - Ethical practice | |||||

| 9 - Social Innovation | |||||

| 10 - First Nations Knowledges | |||||

| 11 - Aboriginal and Torres Strait Islander Cultures | |||||

Textbooks

Auditing Theory and Practice

Edition: 1 (2023)

Authors: Mike Pratt, Karen Van Peursem, Mukesh Garg

Cengage

ISBN: 9780170458955

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

t.nguyen8@cqu.edu.au

Module/Topic

Introduction to audit and auditing profession

Chapter

1 and 2

Events and Submissions/Topic

Module/Topic

Legal environment and ethics

Chapter

3,4 and 5

Events and Submissions/Topic

Release of assessment task 1

Module/Topic

Audit processes and analytical procedure

Chapter

9

Events and Submissions/Topic

Module/Topic

Audit risk and materiality

Chapter

6 and 7

Events and Submissions/Topic

Module/Topic

Audit judgement, audit evidence and audit testing

Chapter

7 and 8

Events and Submissions/Topic

Assessment task 1 is due at 11.45pm on Monday 7th April 2025

Release of assessment task 2

Preparing the Audit engagement letter Due: Week 5 Monday (7 Apr 2025) 11:45 pm AEST

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Audit planning and documentation

Chapter

8 and 10

Events and Submissions/Topic

Module/Topic

Internal control and auditors

Chapter

11 and 12

Events and Submissions/Topic

Module/Topic

Audit sampling

Chapter

13

Events and Submissions/Topic

Assessment task 2 is due at 11.45pm on Monday 5th May 2025

Release of assessment task 3

Practical report Due: Week 8 Monday (5 May 2025) 11:45 pm AEST

Module/Topic

System testing: Sales, purchases and payroll

Chapter

14

Events and Submissions/Topic

Module/Topic

System testing: Warehousing, financing and fixed assets

Chapter

15

Events and Submissions/Topic

Module/Topic

Completion and review

Chapter

16 and 17

Events and Submissions/Topic

Release of oral presentation schedule (AT3B)

Module/Topic

Revision/ Industry partner presentation

Chapter

Events and Submissions/Topic

Assessment task 3A (Written report) is due at 11.45pm on Monday 2nd June 2025

Written and oral presentation assessment Due: Week 12 Monday (2 June 2025) 11:45 pm AEST

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

1 Practical Assessment

This is the first task in an overall integrated research project completed by students over the term. This is an individual assessment. The task is based on an allocated ASX-listed company and each student will be assigned a listed company for the assessment task.

In this assessment, students will need to prepare an audit engagement letter to commence his/her audit job in the allocated company. The engagement letter needs to follow appropriate template and structure with relevant information to be legally acceptable.

Week 5 Monday (7 Apr 2025) 11:45 pm AEST

Online submission via Moodle (No email submission)

Week 7 Wednesday (30 Apr 2025)

Results and feedback will be provided via Moodle

Students are assessed based on their capacity to:

1. Integrate theoretical and technical audit and accounting knowledge in an audit context by demonstrating an understanding of formal process to commence the audit work

2. Justify and communicate audit and accounting advice and ideas in straightforward contexts to assist with the decisions of users of financial reports by being able to choose a relevant approach to communicate with clients in auditing job.

- Integrate theoretical and technical audit and accounting knowledge in an audit context

- Justify and communicate audit and accounting advice and ideas in straightforward contexts to assist with the decisions of users of financial reports

2 Report

This is the continuation of assessment task 1, referring to the same context as in assessment task 1 (same allocated ASX-listed company). This is also an individual assessment task.

After completing the engagement letter, students will write an executive report to:

(1) review the client's business using public available data and

(2) perform audit risk analysis.

These are two steps in the initial planning (Refer to table 9.2 in the textbook for more information). The objective of the assessment is to let students be familiar with the process to obtain an initial understanding of their client before conducting further audit tasks.

***"This assessment requires students to adhere to the guidelines on the use of artificial intelligence tools as specified in the Artificial Intelligence Assessment Scale (AIAS). Any misuse or lack of disclosure regarding the use of AI tools will be considered a breach of academic integrity."

This assessment must be prepared following AI scale level. You should add the following statement at the first page of your assessment report.

Week 8 Monday (5 May 2025) 11:45 pm AEST

Online submission via Moodle (No email submission)

Week 10 Wednesday (21 May 2025)

Results and feedback will be provided via Moodle

Students are assessed based on their capacity to:

1. Exercise judgement under supervision to provide possible solutions to routine audit and accounting problems in straightforward concepts using appropriate regulatory, ethical, economic and governance perspectives

2. Integrate theoretical and technical audit and accounting knowledge in an audit context

3. Critically apply theoretical and technical audit and accounting knowledge and skills to provide possible solutions to routine audit related issues

4. Justify and communicate (in writing) audit and accounting advice and ideas in straightforward contexts to assist with the decisions of users of financial reports

5. Reflect on performance to identify and action learning opportunities and self-improvements.

- Exercise judgement under supervision to provide possible solutions to routine audit and accounting problems in straightforward concepts using appropriate regulatory, ethical, economic and governance perspectives

- Integrate theoretical and technical audit and accounting knowledge in an audit context

- Critically apply theoretical and technical audit and accounting knowledge and skills to provide possible solutions to routine audit related issues

- Justify and communicate audit and accounting advice and ideas in straightforward contexts to assist with the decisions of users of financial reports

- Reflect on performance to identify and action learning opportunities and self-improvements.

3 Practical and Written Assessment

Assessment task 3 is the final task in the integrated research project in this unit. It continues AT1&AT2, but this is a group assessment. TWO to THREE students will form a group and group members will decide which listed company they are going to choose to complete the task (Assuming that all members are working on different companies in AT1&2. If all members are working on the same company in AT1&AT2, then that company will be used for AT3). Group registration will be done via Moodle, and further instructions will be provided closer to the date.

There are two parts in this assessment:

Part 3A: Prepare the second part of the practical report in assessment task 2 and,

Part 3B: Oral presentation about the practical report submitted in AT2 and AT3A.

In Part 3A, students will conduct some specific audit tasks in the audit process and complete the report. Further details about the task will be provided on Moodle.

After submitting all written reports in AT2 and AT3A, students will need to prepare an oral presentation to communicate with clients about the audit process and the final audit outcome.

Timeline of the assessment task 3 as below:

* Week 12 - Submission of the written report in AT3A (as outlined in the due date information in this eProfile)

* Week 13/14 - Oral presentation of the final report (AT2 and AT3A) via Zoom in AT3B - Students will be informed about the time allocation by week 11.

*** "This assessment requires students to adhere to the guidelines on the use of artificial intelligence tools as specified in the Artificial Intelligence Assessment Scale (AIAS). Any misuse or lack of disclosure regarding the use of AI tools will be considered a breach of academic integrity."

In preparing this assessment you are required to follow the following AI scale level and add the following information at the first page of your report.

Week 12 Monday (2 June 2025) 11:45 pm AEST

Online submission via Moodle (No email submission) for the written report.

Results and feedback will be provided via Moodle

Students are assessed based on their capacity to:

1. Exercise judgement under supervision to provide possible solutions to routine audit and accounting problems in straightforward concepts using appropriate regulatory, ethical, economic and governance perspectives

2. Integrate theoretical and technical audit and accounting knowledge in an audit context

3. Critically apply theoretical and technical audit and accounting knowledge and skills to provide possible solutions to routine audit related issues

4. Justify and communicate (both in verbal and writing) audit and accounting advice and ideas in straightforward contexts to assist with the decisions of users of financial reports

5. Reflect on performance to identify and action learning opportunities and self-improvements.

- Exercise judgement under supervision to provide possible solutions to routine audit and accounting problems in straightforward concepts using appropriate regulatory, ethical, economic and governance perspectives

- Integrate theoretical and technical audit and accounting knowledge in an audit context

- Critically apply theoretical and technical audit and accounting knowledge and skills to provide possible solutions to routine audit related issues

- Justify and communicate audit and accounting advice and ideas in straightforward contexts to assist with the decisions of users of financial reports

- Reflect on performance to identify and action learning opportunities and self-improvements.

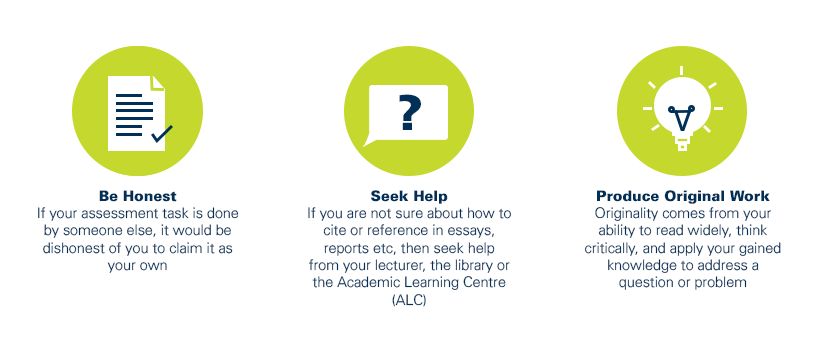

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?