Overview

During this unit, you will apply the theoretical knowledge you attained in preceding units to a professional accounting work environment. This authentic practical experience will allow you to interact with accounting practitioners to further develop your technical skills and professional communication. You will be supervised by a professional accountant to complete tasks that make significant contributions to workplace accounting problems. As this is a 12 credit point unit, you will be expected to commit around 25 hours each week on these supervised tasks, which includes research, task activities, assessment activities and self-directed learning.

Details

Pre-requisites or Co-requisites

To be eligible for enrolment in this unit, students must be enrolled in CQ01 Bachelor of Accounting, Professional Project Major. To gain entry to this major, students must have documented confirmation of support from their employer and the approval of the Head of Course. Approved students must have successfully completed at least 24 credit points of core units prior to enrolment in this unit.

Important note: Students enrolled in a subsequent unit who failed their pre-requisite unit, should drop the subsequent unit before the census date or within 10 working days of Fail grade notification. Students who do not drop the unit in this timeframe cannot later drop the unit without academic and financial liability. See details in the Assessment Policy and Procedure (Higher Education Coursework).

Offerings For Term 2 - 2025

Attendance Requirements

All on-campus students are expected to attend scheduled classes - in some units, these classes are identified as a mandatory (pass/fail) component and attendance is compulsory. International students, on a student visa, must maintain a full time study load and meet both attendance and academic progress requirements in each study period (satisfactory attendance for International students is defined as maintaining at least an 80% attendance record).

Recommended Student Time Commitment

Each 12-credit Undergraduate unit at CQUniversity requires an overall time commitment of an average of 25 hours of study per week, making a total of 300 hours for the unit.

Class Timetable

Assessment Overview

Assessment Grading

This is a pass/fail (non-graded) unit. To pass the unit, you must pass all of the individual assessment tasks shown in the table above.

All University policies are available on the CQUniversity Policy site.

You may wish to view these policies:

- Grades and Results Policy

- Assessment Policy and Procedure (Higher Education Coursework)

- Review of Grade Procedure

- Student Academic Integrity Policy and Procedure

- Monitoring Academic Progress (MAP) Policy and Procedure - Domestic Students

- Monitoring Academic Progress (MAP) Policy and Procedure - International Students

- Student Refund and Credit Balance Policy and Procedure

- Student Feedback - Compliments and Complaints Policy and Procedure

- Information and Communications Technology Acceptable Use Policy and Procedure

This list is not an exhaustive list of all University policies. The full list of University policies are available on the CQUniversity Policy site.

- Identify and communicate appropriate and effective accounting solutions to workplace problems

- Apply professional competence and due care to complete individual and team goals, tasks, responsibilities and schedules

- Collect and interpret evidence from a range of quality sources to inform decisions on workplace accounting problems

- Critically reflect on personal contributions to business improvements, and identify further areas of learning and professional development.

Alignment of Assessment Tasks to Learning Outcomes

| Assessment Tasks | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Portfolio - 0% | ||||

| 2 - Learning logs / diaries / Journal / log books - 0% | ||||

Alignment of Graduate Attributes to Learning Outcomes

| Graduate Attributes | Learning Outcomes | |||

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| 1 - Communication | ||||

| 2 - Problem Solving | ||||

| 3 - Critical Thinking | ||||

| 4 - Information Literacy | ||||

| 5 - Team Work | ||||

| 6 - Information Technology Competence | ||||

| 7 - Cross Cultural Competence | ||||

| 8 - Ethical practice | ||||

| 9 - Social Innovation | ||||

| 10 - First Nations Knowledges | ||||

| 11 - Aboriginal and Torres Strait Islander Cultures | ||||

Textbooks

There are no required textbooks.

IT Resources

- CQUniversity Student Email

- Internet

- Unit Website (Moodle)

All submissions for this unit must use the referencing style: American Psychological Association 7th Edition (APA 7th edition)

For further information, see the Assessment Tasks.

s.kutubi@cqu.edu.au

Module/Topic

Professional standards and the professional accountant

Chapter

Refer to publications by IESBA and APESB contained in your e-Reading List.

Events and Submissions/Topic

Refer to your workbook for activities and assessment details.

Module/Topic

Professional standards and the professional accountant (continued)

Chapter

Refer to publications by IESBA and APESB contained in your e-Reading List.

Events and Submissions/Topic

Refer to your workbook for activities and assessment details.

Module/Topic

Mapping your future: APES 110 and your personal capability gap analysis

Chapter

Refer to publications by IESBA and APESB contained in your e-Reading List.

Events and Submissions/Topic

A capability gap matrix will be provided for your on Moodle.

Module/Topic

Mapping your future: APES 110 and your personal capability gap analysis

Chapter

Refer to publications by IESBA and APESB contained in your e-Reading List.

Events and Submissions/Topic

A capability gap matrix will be provided for your on Moodle.

Module/Topic

Reviewing your project plan

Chapter

Events and Submissions/Topic

Refer to your workbook for activities and assessment details.

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Submitting your project plan

Chapter

Events and Submissions/Topic

Module/Topic

Project week

Chapter

Events and Submissions/Topic

Module/Topic

Project week

Chapter

Events and Submissions/Topic

Module/Topic

Project week

Chapter

Events and Submissions/Topic

Module/Topic

Preparing the project report

Chapter

Events and Submissions/Topic

Module/Topic

Submit project report and update your e-Portfolio

Chapter

Events and Submissions/Topic

Module/Topic

Complete and submit your e-Portfolio

Chapter

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

Module/Topic

Chapter

Events and Submissions/Topic

To commence study in this unit, you must have a signed approval from your employer and your professional accountant mentor. You will find the approval of the final page of the Professional Practice Major Protocol document located in Moodle (in the section called WELCOME TO ACCT11084 ACCOUNTING IN PROFESSIONAL PRACTICE). This document must be signed by both you and your employer, and uploaded via the secure upload link provided in Moodle prior to the conclusion of Week 1. This protocol document sets out the expectations and responsibilities of the student, employer and CQUniversity. These must be acknowledged prior to commencing this unit.

1 Portfolio

For this assessment, you will be introduced to your personal e-Portfolio. This e-Portfolio can be used throughout your learning journey to highlight your achievements for showing potential employers. You are required to post your personal capability matrix on Portfolium, as well as an abbreviated version of your critical reflection on what you will do during your learning journey.

You will also post reflections on your project and experience that you have gained from undertaking it.

Week 12 Friday (10 Oct 2025) 11:45 pm AEST

This assessment will be assessed as follows:

- Clear and readable presentation of the capability matrix

- Clear and well-presented critical reflections on your personal gap analysis and your project

- Quality and readability of your overall presentation in Portfolium.

This assessment is a pass/fail assessment. No grade is provided.

- Identify and communicate appropriate and effective accounting solutions to workplace problems

- Apply professional competence and due care to complete individual and team goals, tasks, responsibilities and schedules

- Collect and interpret evidence from a range of quality sources to inform decisions on workplace accounting problems

- Critically reflect on personal contributions to business improvements, and identify further areas of learning and professional development.

2 Learning logs / diaries / Journal / log books

Your Work Book contains several activities for you to undertake in your workplace during the term. These include, but are not limited to:

- Making a presentation to your workplace mentor or to your colleagues

- Developing a personal capability gap analysis, with critical reflections

- Developing an approved project plan with your mentor

- Completing the approved project and providing your critical reflections on the completion of the project.

Week 11 Friday (3 Oct 2025) 11:45 pm AEST

Your activities will be assessed by your Unit Coordinator and your workplace mentor as either Satisfactory or Not Satisfactory. You must achieve a Satisfactory score on all activities.

- Identify and communicate appropriate and effective accounting solutions to workplace problems

- Apply professional competence and due care to complete individual and team goals, tasks, responsibilities and schedules

- Collect and interpret evidence from a range of quality sources to inform decisions on workplace accounting problems

- Critically reflect on personal contributions to business improvements, and identify further areas of learning and professional development.

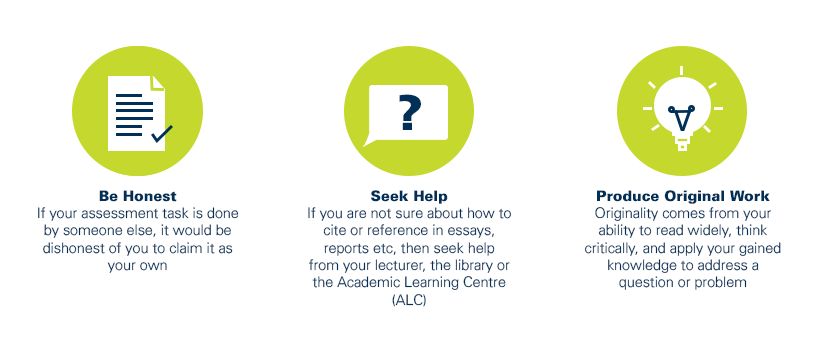

As a CQUniversity student you are expected to act honestly in all aspects of your academic work.

Any assessable work undertaken or submitted for review or assessment must be your own work. Assessable work is any type of work you do to meet the assessment requirements in the unit, including draft work submitted for review and feedback and final work to be assessed.

When you use the ideas, words or data of others in your assessment, you must thoroughly and clearly acknowledge the source of this information by using the correct referencing style for your unit. Using others’ work without proper acknowledgement may be considered a form of intellectual dishonesty.

Participating honestly, respectfully, responsibly, and fairly in your university study ensures the CQUniversity qualification you earn will be valued as a true indication of your individual academic achievement and will continue to receive the respect and recognition it deserves.

As a student, you are responsible for reading and following CQUniversity’s policies, including the Student Academic Integrity Policy and Procedure. This policy sets out CQUniversity’s expectations of you to act with integrity, examples of academic integrity breaches to avoid, the processes used to address alleged breaches of academic integrity, and potential penalties.

What is a breach of academic integrity?

A breach of academic integrity includes but is not limited to plagiarism, self-plagiarism, collusion, cheating, contract cheating, and academic misconduct. The Student Academic Integrity Policy and Procedure defines what these terms mean and gives examples.

Why is academic integrity important?

A breach of academic integrity may result in one or more penalties, including suspension or even expulsion from the University. It can also have negative implications for student visas and future enrolment at CQUniversity or elsewhere. Students who engage in contract cheating also risk being blackmailed by contract cheating services.

Where can I get assistance?

For academic advice and guidance, the Academic Learning Centre (ALC) can support you in becoming confident in completing assessments with integrity and of high standard.

What can you do to act with integrity?